The average American consumer doesn’t realize that “Made in the U.S.A…”, as found on almost every vitamin bottle on the store shelf, is only truthful to a point. Brand manufacturers have been addressing this issue for years through education and reassurance, stating that it is not where the ingredient is made but ‘how’ it is made. Also, manufacturers use the reassurance of product testing to underscore the safety of the ingredients. Now Foods CEO Jim Emme, for instance, states on a Now Foods web page:

“We’re focusing on developing direct sourcing relationships with supply manufacturers around the world, so we have more control over quality before the ingredients arrive at our facilities and undergo quality assurance testing.”

This NOWledge page continues to discuss the importance of the direct relationships with the manufacturers and describes the audits and testing conducted to ensure safety and quality. Now Foods acknowledges that to exclude sourcing from a specific country, like China, would eliminate the ability to source many ingredients such as Vitamin C, B Vitamins and more.

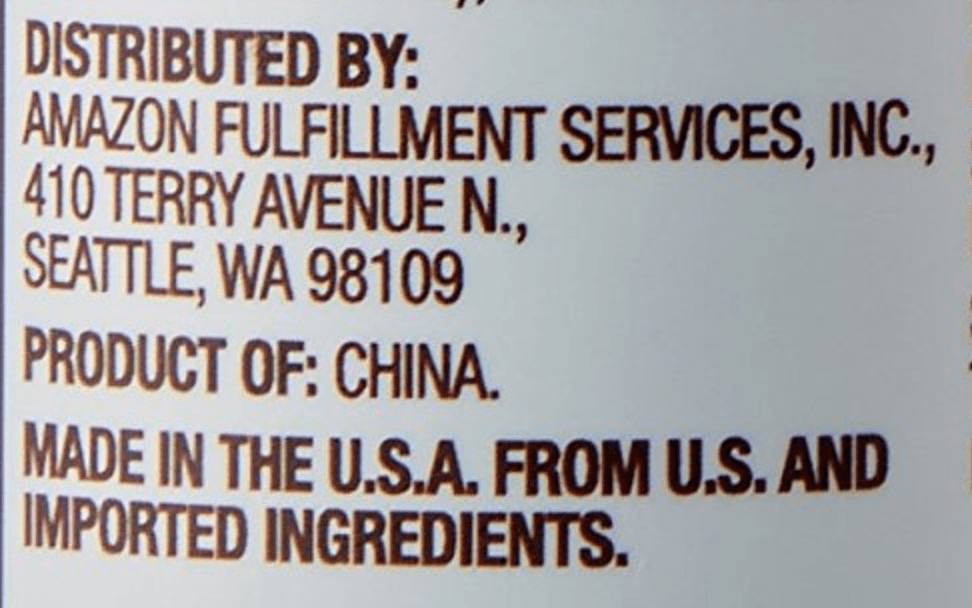

Major brands have managed to become successful despite openly and transparently admitting that many of their ingredients come from China. The Amazon Elements brand displays country of origin for each ingredient used in its products. 60% of the Amazon Elements brand utilizes at least one ingredient sourced from China and 100% of the brand has at least one ingredient imported.

All of this confirms that we, as an industry, depend on China as a supplier. The dietary supplement industry, for the most part, managed to work through much of the country of origin issues. We are about to feel the impact of the trade wars though. While some vitamins have been assessed tariffs and others have avoided being impacted by the tariffs themselves, impacts are still realized in total. The threat of tariffs for all Chinese imports is very real. If the remaining tariff implementation happens we will certainly see direct impacts as all the Chinese ingredients we use will automatically be included on the tariff list and costs will rise.

It might be easy to think the answer is to just start manufacturing the ingredients in the United States. United States manufacturers cannot affordably build facilities to the scale required to serve the demand required. The CoQ10 Association filed an appeal to the US Trade Representative and conducted an economic analysis of the impact of a 25% tariff as it relates to that Coenzyme Q10 alone. The group estimated United States consumers would end up paying an additional $400 million annually. The Natural Product Association (NPA) testified before Congress and stated US jobs will be lost and small businesses will fail if the tariffs on vitamin and dietary supplements ingredients are implemented.

The tariff issue has sparked public action requests from all industry trade associations including UNPA, CRN, AHPA, NPA and several others. Michael McGuffin, president of the American Herbal Product Association (AHPA), remarked the purpose of the United States Trade Representative (USTR), as indicated in the Trade Act of 1974 is “to foster the economic growth of and full employment in the United States...” and “...to assist industries, firm[s], workers, and communities to adjust to changes in international trade flows.” McGuffin has requested the USTR to remove all herbal product ingredients from any proposed tariff list. Daniel Fabricant, Ph.D., president and CEO of the NPA, in a press release said the trade organization has been working with the Trump administration since September 2018 to secure an exclusion process. “Without exclusions for our industry, these new China 301 tariff proposals will increase costs for small businesses and the majority of Americans who rely on dietary supplements to support their healthy lifestyles,” The exclusion process advocated by NPA and others was granted and began June 30. Fabricant commented “We still have a lot of work to do because the natural products industry was just hit with the proposed List 4 China 301 tariffs earlier this month. List 4 includes many new dietary ingredients used in dietary supplements as well as personal and home care ingredients and products.”

The economic impact from the imposed tariffs is only one effect as some ingredient manufacturers have raised prices in anticipation of proposed tariffs. In addition to this U.S. consumer cost hit, the war has altered sentiment from the Chinese people and government, encouraging them to find new markets for ingredients originally intended for U.S. manufacturing. Australia’s economy also benefitted greatly in 2018 as a result of the trade tensions between the U.S. and China. It was recently reported that China’s largest import of vitamins no longer comes from the United States. Australia has leapfrogged the United States as China’s leading provider of dietary supplements. This provides the Australian manufacturers with a volume price advantage for the ingredients historically manufactured in the United States. Ultimately, a U.S. market impact will certainly be higher prices for retailers and consumers.

Aside from recognizing the impact of the trade war what can we do as natural retailers to mitigate or accommodate the price pressures. Calm, Compromise, and Communication are key to weathering any storm that might develop as a result of the tariffs.

- Calm – It is important to keep the entire direct economic impact of the tariffs in perspective. The contribution of raw materials is typically 55%-65% of production costs. This cost can be higher if branded ingredients are used and lower if non-branded commodity ingredients are utilized. The total contribution of raw materials to the final retail product, on average, only accounts for approximately 10% -15% of the consumer price. The average dietary supplement consumer will pay an estimated $22 more per year for their products. The average CoQ10 consumer will likely pay an additional $20 more annually per year for that ingredient. By itself, the impact might not be sufficient to make a difference to your consumer base, but the price elasticity for consumers is always a concern.

- Compromise – Many Chinese ingredient manufacturers are understanding the full impact of the tariffs should not be passed on to their customers. Also, many United States manufacturers have maintained above average inventories in case the tariffs affect their products. The end result will likely be all elements of the supply chain, including the retailer and eventually the consumer, will absorb the total impact of any tariff impact. Retailers should plan on some impact from the tariffs and be prepared to accept some margin deterioration and/or consumer reaction.

- Communication – Communication and education will continue to be the key to success in retail. Communication with your suppliers and proactive discussions surrounding the tariffs impact will provide valuable information that will allow you to anticipate challenges or changes. Additionally, preparing FAQs to address consumer inquiries will be beneficial.

Note: The views and opinions expressed here are those of the author(s) and contributor(s) and do not necessarily reflect those of the publisher and editors of WholeFoods Magazine.