Today’s consumer is not one who will willingly take the good with the bad if there is a better option. This holds true in all aspects of retail. For instance, who wants a CD player when you can have an iPod that holds all of your music, takes pictures and doubles as a phone? In the same respect, who wants a sweetener that will raise your blood sugar when there are natural alternatives that taste just as good and provide an added health benefit?

The competition in the sweetener market is getting tight and alternatives to table sugar no longer appeal only to dieters or those with special needs such as diabetics. While these individuals still represent a strong market share of the sweetener category, others interested in general health or unique flavor profiles are contributing to demand. Beverage and food manufacturers have also introduced innovative products utilizing alternative sweeteners that have attracted additional consumer interest. In fact, notes Paul Block, CEO of Merisant and Whole Earth Sweetener Company, both based in Chicago, IL, “An International Food Information Council (IFIC) Foundation Food and Health survey in 2006 found that a majority of the American population is actively trying to avoid sugar, primarily to control weight and manage blood sugar.”

Steps to Superiority

Steps to Superiority

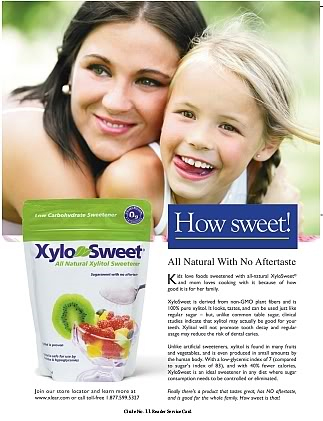

It is as if the alternative sweetener market has hit a peak in regard to options, consumer appeal and taste. This, however, has been a process of innovation and discovery that continues to expand with different applications and exotic ingredients. Brian Craig, vice president of Xlear Inc., based in Orem, UT, explains, “Years ago people who were looking for alternative sweeteners were primarily concerned just about the calorie content of the sweetener. Suddenly, when all of the adverse health concerns began to be published, people wanted products that were lower in calories and safe.”

Consumer standards for alternative sweeteners have only grown with time. Craig highlights the Atkins phenomena that resulted in sweeteners shifting from low calorie to those that focused on “net carb value.” “Today,” he adds, “while there is still a lot of controversy about the safety of sweeteners like aspartame, the latest focus, at least from consumers, seems to be taste—they still want products that are safe and ideally lower in calories, but taste is the biggest issue.”

In other words, today’s consumer wants the full package, and if your store falls short in its selection of alternative packet sweeteners and sweetened finished products, it may also fall short in sales. More importantly, the masses want these alternatives to be natural. “Recent studies show that consumers are seeking a natural alternative to sugar and artificial sweeteners. According to SPINS attitudinal research in 2007,” Block explains, “the natural food movement is gaining global momentum and natural foods are widely perceived to be both healthier and safer.”James A May, president and CEO of Gilbert, AZ-based Wisdom Natural Brands, adds that the 2008 IFIC Food and Health Survey found that 43–45% of Americans want to use less aspartame, sucralose and saccharine. In contrast, he notes, 26% wanted to increase their use of the natural sweetener stevia.

“This [natural shift] is likely due to an increased awareness about high-fructose corn syrup and the glycemic index,” says Arnold Coombs, general manager at Coombs Family Farms, Brattleboro, VT. “And, while artificial sweeteners have grown exponentially, consumer awareness about natural and organic sweeteners also has grown. A general consumer trend exists of a return to simpler times: unprocessed and unrefined sweeteners that come from nature without preservatives and additives.”

The Fight for Natural

The Fight for Natural

Jake Jacobson, vice president of sales and business development for Omezing LLC of Aventura, FL, is an adamant supporter of the natural products industry and while believing the increase in natural alternative sweeteners is encouraging, he thinks more should be done to support natural product development. “The natural market was pushed aside by capitalism, greed and the lack of regard for health as a priority in our society. Is it really necessary for product development teams to search for natural sweeteners?” he questions. “How to integrate natural products with stability, extended shelf life and the nutritional value inherently in the products should be the R&D being done.”

Jacobson adds that in terms of a natural sweetener, the focus is what’s “NOT in it or [what] has not been done to it in the refinement process.” More and more consumers are aligning with this thought process and Jacobson believes pressure should be placed on regulatory agencies to support natural formulations. “It would be interesting to see how many jobs could actually be created if we maximized U.S. farmland with natural food giving us natural sweeteners,” he says.

This barrier the natural products industry has faced can be clearly seen in the history of the stevia market. Oscar Rodes, president and founder of Stevita Co., explains his company’s struggle with introducing the natural sweetener to the American market. “In 1989, I met with FDA (U.S. Food and Drug Administration) officials and introduced steviosides and declared our intention to sell the stevia extracts as tabletop sweeteners,” he says. At the time, says Rodes, whole or ground leaves were the only stevia on the market. “I was told that they were concerned about the huge impact that stevia would have on consumers health because they expected that stevia in the form of crystal powder would substantially replace all the other sweeteners, natural and artificial, in the market.” To ensure safety, the FDA gave Rodes a list of safety tests that would have to be performed—costing about $10 million and lasting more than five years. Not surprisingly, the company decided to forget about the resisting American market and enter the Brazilian (where the company is based) and Japanese markets. It was not until after the passage of DSHEA in 1994 that the company made it back to the States in 1996 supporting a new label requiring the term “dietary supplement.”

May of Wisdom Natural Brands says that FDA’s requirement to market the sweetener as such created a limited market for stevia because “consumers were not permitted, by FDA regulation, to be informed that stevia tasted sweet or enhanced the flavor of food and beverages.”

Scott Taylor of Pacific Palisades, CA-based Purpose Foods, LLC, another company that carries a specific stevia extract called rebiana, concurs that the FDA had spent decades resisting the sweetener. Recently, however, the presumed FDA GRAS status for certain stevia products on the market has sparked consumer interest.

Supply and Demand

Supply and Demand

Aside from regulations, other barriers denying the expansion of the natural market are incontrollable. Demand all-too-often outweighs supply as the popularity of this category grows. “I can only speak for maple; the industry can handle a growth rate of 5–7% per year,” says Coombs. “A problem arises when Mother Nature throws us a curve ball and the crop isn’t near an average volume (especially year over year),” he explains. “This creates shortages and drives up prices which may in turn, get farmers to increase their production, but of course higher prices impede consumer acceptance of the product.” Also, he notes, sustainable forestry must be taken into account and “we champion our fellow small family farms.”

In regard to stevia, says May, there is a significant shortage of leaves now. He explains that as the sweetener moves toward FDA approval, bigger companies entering the market are racing to purchase current and future crops worldwide. May remains optimistic, though. “Wisdom Natural Brands is working with small farmers throughout the world and contracting with them to grow Stevia. In time, the agriculture limitations will be overcome and sufficient stevia extract will be available to enter into the mainstream food and beverage arena and satisfy the desires of the American consumers, he says.”

Whole Earth Sweeteners, which has partnered with PepsiCo, has secured its own supply in Paraguay, says Block, “where native stevia has been a natural sweetener for centuries.” He also notes that the company has partnered with Imperio Guarani in Paraguay “to develop a network of small farmers who use simple and sustainable farming techniques to grow stevia for us.”

Taylor also highlights Purpose Foods Sweet Fiber product, which is made with luo han guo. The source, he says, “is a cultivated fruit [that] is in relatively short supply compared to other sweeteners. The Chinese government,” he adds, “is rapidly expanding production by supporting several manufacturers, but the potential supply limitations on luo han guo have constrained demand at this time.”

Another instance of this can be seen in the xylitol market, says Xlear’s Craig. “We have seen price fluctuations with the cost of xylitol—demand far outstripped supply about a year to a year-and-a-half ago. The prices almost doubled during that period,” he explains. “It, along with a few other factors, has caused us to work closely with researchers to seek out additional extraction and production techniques.”

A New Generation

Despite certain pressures the industry is facing, natural sweeteners certainly appear to be the wave of the future, whether on your tabletop or in the newest beverage or food product. “I believe the natural sweetener market is going to experience double-digit gains for many years to come, as people switch from artificial and caloric sweeteners to zero-calorie natural sweeteners,” says Taylor. “The health benefits from natural sweeteners are big enough to warrant switching from cheaper alternatives.”

Coombs agrees that the future is bright for the sector. “Pricing and supply are the major variables. As the industry grows,” he says, “some of the volatility is removed. This in turn helps the market grow.”

Also optimistic, Craig believes the natural sweetener market is opening up an array of options for diabetics, a condition becoming increasingly common in the United States. He explains that many suffering from diabetes will tend to crave “prohibited” food items, but helping “them understand what options or sweetener alternatives are available to them” will help them maintain a healthy and satisfying diet.

Jacobson of Omezing is also confident that companies will go above and beyond the strategies of the past and “grab hold of social responsibilities and lead us into healthier sweetener options across food and beverage products. Perhaps the focus on natural foods, organics and vegetarian diets in time,” he says, “will even stymie the development of alternative sweeteners that are posing such drastic health concerns.”

Where will the market expand to next? Considering the inherent benefits of many of these naturally sweet alternatives, the next plateau to be conquered by this category may be functional foods. “Functional sweeteners or sweeteners with built-in health benefits are gaining traction in the marketplace,” says Taylor. “Purpose Foods (Sweet Fiber), Wisdom (Sweetleaf Sweetener) and NOW Foods (Stevia Balance with Inulin) market sugar substitutes with soluble fiber in the form of inulin.” The fiber trend has even hit the mainstream, notes Taylor, with artificial sweeteners like Splenda offering fiber options.

“Consumers are starting to understand more of the benefits of fiber as the fiber-marketers do a better job of explaining what a prebiotic is, how mineral absorption is improved, how fiber helps with satiety, etc.,” says Taylor. He also comments that Sweet Fiber is certified gluten free, which makes it an acceptable sweetener alternative for people suffering from Celiacs. Taylor explains that over three million celiacs suffer from an autoimmune digestive disease, making a sweetener with added fiber very beneficial to them.

Xylitol has made its way into different chewing gums, mouth sprays, toothpastes and other finished products serving as both a sweetener and a component to help reduce tooth decay. Craig says that xylitol is not ideal for sweetening beverages, which are growing in the functional category. However, he notes, “When fiber is added to the mixture, xylitol works very well.”

The herbal dietary supplement stevia also has its fair share of health attributes. Neil E. Levin, CCN, DANLA, a certified clinical nutritionist with NOW Foods of Bloomingdale, IL, notes the work of physician and health columnist Patrick B. Massey, M.D., which states that “stevia stimulates insulin secretion, normalizes glucose response and reduces high blood pressure without reducing normal blood pressure by acting as a natural calcium channel blocker (magnesium is another example) and by acting as a minor diuretic.”

Omezing has added another option to the functional sweetener category with its patent pending Omezing Powder derived from a proprietary vegetable seed oil. The product, which contains high concentrations of Omega-3, -6, -9, says Jacobson, “is metabolized by the human body more efficiently than any other omega products in the marketplace. Omezing,” he adds, “has high levels of vitamin E, which may also slow the oxidation of bad (LDL) cholesterol, prevent blood clot formation, enhance immune response and benefit the nervous system.” The powder is neutral in odor and taste and natural cane sugar is added to the formulation for sweetness.

Taylor concludes that the trend toward functional sweeteners will keep accelerating “as people begin to take more responsibility for their diet and their health.” As for the category as a whole, natural sweeteners will continue to grow and more options with unique attributes will keep consumers coming back for more. WF

|

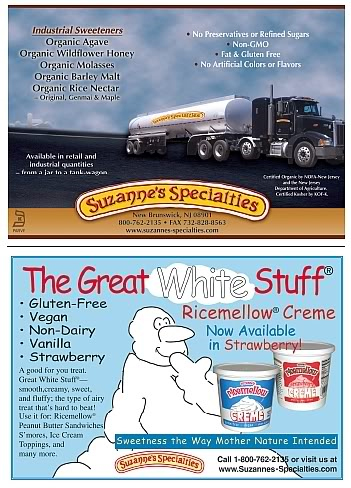

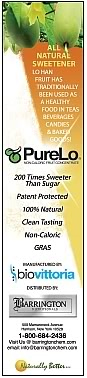

Sweetening Your Sales Following is some information regarding some of the hottest new sweeteners on the market, along with some of the many natural products companies now carrying them. The Traditional Option Products: Coombs Family Farms 100% Pure and Organic Maple Granules; Florida Crystals organic and natural granulated, brown and powdered sugars; Omezing natural sugar with added omegas; Sun Crystals Raw Cane Sugar and Erythritol. Syrup-Like Sweeteners Other natural sweeteners that fall in this category include brown rice syrup, barley malt and maple syrup. Arnold Coombs of Coombs Family Farms says maple, in particular, is being used in more and more applications and consumers want natural and organic varieties. Products: Coombs Family Farms 100% Pure and Organic Maple Syrup; Himalaya Herbal Healthcare Soliga Forest Honey; NOW Foods Fructose Fruit Sugar; Really Raw Honey; Suzanne’s Specialties Organic Agave, Maple Rice Nectar, Barley Malt Extract, Wildflower Honey and more; Wholemato Organic Agave Ketchup; Wholesome Sweeteners Agave. Powders and Extracts An extract of the luo han guo fruit native to Asia, has also found its way in the natural sweetener aisle. Also like stevia, it has an intensely sweet flavor, is low caloric and low glycemic. Information from Barrington Nutritionals also notes that its luo han guo ingredient is highly stable and soluble, making it applicable for use in beverage, food and confectionary products. Products: Barrington Nutritionals PureLo Luo Han Guo Fruit Concentrate; Cargill Truvia stevia (rebiana); NOW Stevia Balance with inulin and chromium; Purpose Foods Sweet Fiber (luo han guo sweetener with chicory root for added fiber); Stevita Stevia products; Whole Earth Sweetener Company’s PureVia stevia extract with fruit and honey flavors; Wisdom Natural Brands SweetLeaf Sweetener with inulin fiber and SteviaClear. Polyols (Sugar Alcohols) Products: NOW Xylitol packets and bulk; Sun Crystals Raw Cane Sugar and Erythritol; Xlear XyloSweet, Spry Dental Gum and other xylitol products; Zweet Erythritol Zero Calorie Sweetener. |

Published in WholeFoods Magazine, November 2008