Attention Retailers: Clean up needed on the e-commerce aisle. There’s a collective mess out there and failing to attend to this issue can result in harm to natural product stores, industry and consumers. This mess involves poor quality and falsified products that do not uphold the standards reputable companies seek to provide to their customers. The reason this mess exists has everything to do with the rapidly changing environment that has significantly lowered the barrier of entry to the market, while not ensuring a viable process to ensure product integrity and quality.

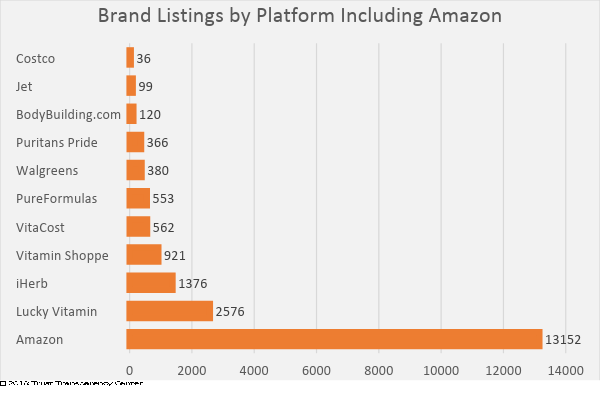

Recently, concerns have been raised by brands, consumers and retailers regarding products being marketed in the e-commerce sector, specifically the Amazon marketplace. The majority of complaints received involved Amazon-offered products, which is perfectly understandable. Amazon has demonstrated a willingness to accept substantially greater numbers of brands with fewer qualifications for market entry. A 2018 survey of the marketplace, conducted by Trust Transparency Center, showed this disparity:

While it is virtually impossible to monitor the quality and integrity of all of the brands offered on Amazon, organizations have started testing products to verify label claim, and the results threaten credibility.

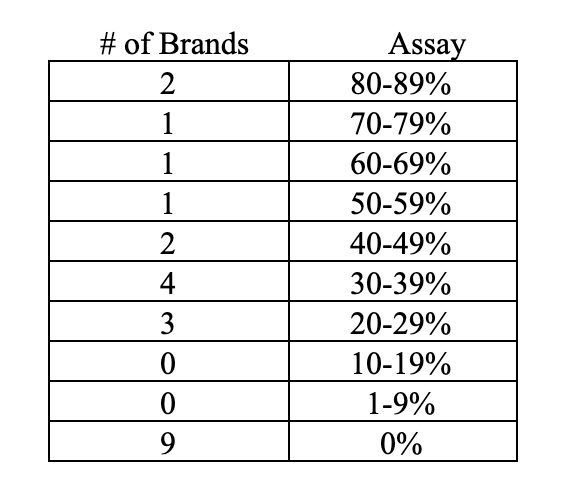

While it is virtually impossible to monitor the quality and integrity of all of the brands offered on Amazon, organizations have started testing products to verify label claim, and the results threaten credibility. For instance, the CoQ10 Association recently tested a sample of 100 of the 860 unique CoQ10 brands listed on Amazon—a small sample, yet representative of brands of all sizes. These third-party tests found that only 34% tested at or above 100% of label claim while the rest were below label claim. In total, 77% were at 90% or more of label claim. This threshold of 90% assay is important because many contract manufacturers maintain a 10% variance as an acceptable tolerance for product manufacturing, so one can argue that these 77% represent an attempt at accuracy and could also be indicative of a possible normal deterioration of assay due to aging on shelf. The issue of efficacy is especially concerning when the assay is below 90% of label claim and 23 of the products fell into this category:

Letters with these findings were sent to all 66 brands confirmed to assay below 100% and only 13 brands responded to the letters. The result: Three brands were immediately discontinued, and seven brands committed to rectifying the results and were retested at a later date with improvement. Three brands disputed the lab findings. Also, of note, 36 letters addressed to the contact provided on the bottle failed to deliver because of incorrect address provided or returned as no longer at the address.

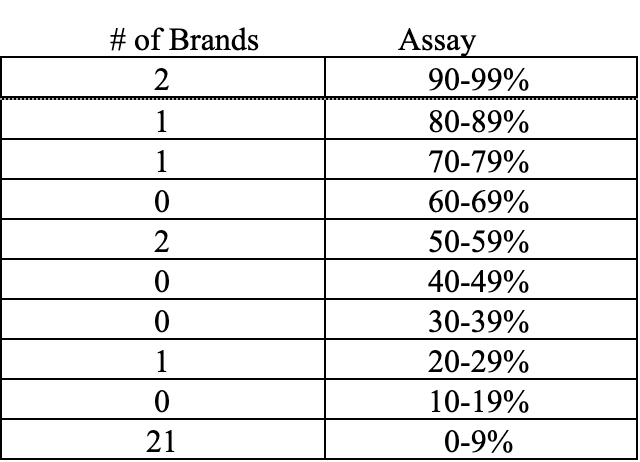

Letters with these findings were sent to all 66 brands confirmed to assay below 100% and only 13 brands responded to the letters. The result: Three brands were immediately discontinued, and seven brands committed to rectifying the results and were retested at a later date with improvement. Three brands disputed the lab findings. Also, of note, 36 letters addressed to the contact provided on the bottle failed to deliver because of incorrect address provided or returned as no longer at the address. The Natural Algae Astaxanthin Association (“NAXA”) tested a 50 brand sample of the 361 astaxanthin brands listed on Amazon. Note that a majority of the brands stating they contain astaxanthin only provide krill oil, which has small amounts of naturally occurring astaxanthin. NAXA only tested products that contained the label claim of astaxanthin derived from Haematococcus pluvialis. The testing conducted at the industry-recognized gold-standard astaxanthin testing lab in the United States evaluated the products for assay of label claim and also tested to confirm the algae on the label was natural astaxanthin derived from Haematococcus pluvialis.

This current round of testing did not indicate falsification of ingredient, however 28 of the 50 brands tested by NAXA failed to meet 100% label claim of astaxanthin. The breakdown of those products is as follows:

Letter of findings were sent to the 28 brands confirmed to assay below 100%; five brands responded to the letters sent detailing the findings. Three brands were immediately discontinued. One brand committed to rectifying the results and were retested at a later date with improvement. One brand relabeled the product to correctly state the content. Also, of note, 26 letters addressed to the contact provided on the bottle failed to deliver because of incorrect address provided or returned as no longer at the address. Again, these companies could not be located.

Letter of findings were sent to the 28 brands confirmed to assay below 100%; five brands responded to the letters sent detailing the findings. Three brands were immediately discontinued. One brand committed to rectifying the results and were retested at a later date with improvement. One brand relabeled the product to correctly state the content. Also, of note, 26 letters addressed to the contact provided on the bottle failed to deliver because of incorrect address provided or returned as no longer at the address. Again, these companies could not be located.Both labs used USP monograph testing procedures widely used and agreed to be the most common methodologies. The results of the tests have confirmed the concerns expressed by industry and consumers. The tests, in addition to showing lack of adherence to label claim, demonstrate that there is shared responsibility and accountability needed by both well established brands as well as lesser established brands in order to resolve this credibility threat. Brick-and-mortar retailers, responsible and in the know, as gatekeepers, should be asking questions of their brands and cementing the close relationships that in many cases already exist so that they are not exposed when these results come out—and they eventually will.

The CoQ10 Association and NAXA have attempted to make direct contact with Amazon (under an NDA if appropriate) to discuss the situation, but no response has yet been received. The trade associations have deliberately not identified the manufacturers in question because it is acknowledged that a variety of issues can impact the results of product testing. The misrepresentations found can be due to a lack of knowledge of how to provide a compliant product, not necessarily a deliberate intent to defraud—and education and education would be a prudent first recourse. Without engagement with e-tailers like Amazon, that exposure and risk (and education) cannot be addressed, which is a shame for the marketplace, but an opportunity for traditional retail.

What’s the solution? First and foremost, the problem must be acknowledged as a problem and e-commerce players should hold themselves to a higher standard of regulatory compliance. The current attitude displayed by Amazon seemingly indicates an attitude of “buyer beware.” This approach may work fine when selling numerous “widgets,” such as belt buckles and light bulbs, but is not acceptable for ingestible nutritional products.

Communication of transparency will reaffirm the trust necessary to ensure this small industry problem does not grow to a larger, disastrous proportion. Ingredient manufacturers, brands and retailers should support third-party testing program initiatives at every stage of the supply chain, especially with contract manufacturers. Consumers, e-commerce brands and natural retailers should be educated to the fullest extent as to what regulations and requirements are necessary, including:

- Testing SOPs by ingredient and brand

- Third-party tests

- Transparency of manufacturer identity and operations

- Assay results based upon actual analysis and not simply manufacturer inclusion in production

- Accurate contact information from the brand

Disclosure: Scott Steinford is a managing partner with Trust Transparency Center which manages the CoQ10 Association and the Natural Algae Astaxanthin Association.