In July, the U.S. Food and Drug Administration (FDA) made public a proposed guidance for new dietary ingredients (NDIs) that are included in supplements. Though the document is aimed at finished product manufacturers, it could have a profound affect on raw materials suppliers.

“It is tough to predict what the final version will include, but certain interpretations could have a very big impact on the supplement market as we know it today,” says Scott Steil, president of Nutra Bridge, Shoreview, MN.

Brief Background

To bring everyone up to speed, here’s a quick and dirty history of the new NDI draft guidance.

Congress forever changed the dietary supplement industry when it amended the Federal Food, Drug and Cosmetic Act by passing the Dietary Supplement Health and Education Act (DSHEA) in 1994. Among the many items stipulated in the law, DSHEA stated that 75 days before new dietary ingredients could be sold to the public, companies distributing the ingredient (or marketing a finished product containing it) would be required to notify FDA. NDIs were “reasonably expected to be safe”; upon  reviewing the filing, FDA would either acknowledge the notification or object to it. Industry considered “new” ingredients to be anything marketed after the passing of DSHEA; those sold prior to October 15, 1994 were presumed safe (unless events showed something to the contrary).

reviewing the filing, FDA would either acknowledge the notification or object to it. Industry considered “new” ingredients to be anything marketed after the passing of DSHEA; those sold prior to October 15, 1994 were presumed safe (unless events showed something to the contrary).

Since 1994, numerous industry suppliers have attempted to go through the NDI notification process, which has been a frustrating experience for many. Of the more than 600 notifications filed since August 1995, just over one-quarter have been acknowledged (1). Companies, tired of running into a brick wall, began asking the agency to clarify the NDI notification process. The result is a draft guidance released in July 2011, which few believe is suitable as it stands.

The comment period for the new draft guidance closed last month (December 2011), and only time will tell what the final guidance will look like. But one thing is for certain: we could see some changes in the supplier–marketer relationship as a result.

“The NDIN process always has and will continue to be positive for industry,” believes Melody Harwood, director of regulatory affairs for Aker BioMarine Antarctic AS, Oslo, Norway, with U.S. headquarters in Issaquah, WA. “It allows industry to be responsible manufacturers and distributors of dietary supplement products with no mandatory requirements for registration on a product-by-product basis, essentially as drugs, which is common in many other jurisdictions such as Australia and Canada.”

She acknowledges some of the draft’s most troublesome points (like the ineligibility of synthetic copies of ingredients and the potential limitation of bacteria unless they appeared in foods). “I hope industry and government can work together in a conciliatory fashion to make revisions to the draft so that a final Guidance for Industry can be published that manufacturers and distributors of dietary supplements and representatives of the agency can work with in harmony,” Harwood says.

Innovation Stopper?

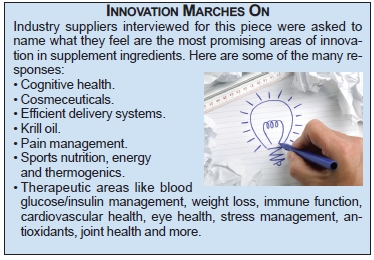

One bone of contention among supplement makers is that the guidance—if  passed without revision—could stifle innovation in the nutrition industry and lead to the removal of many wonderful products. Part of the reason is FDA’s reinterpretation of the 1994 grandfathered list. Any ingredients that are “chemically altered”—such as being modified through milling or lyophilization, or even prepared using CO2 extraction—would be considered new and in need of FDA notification. This could amass a ton of paperwork, given the proposed product-by-product notification process. Companies may be forced to focus on fewer, less innovative products rather than file numerous expensive notifications. Even FDA may have trouble keeping up.

passed without revision—could stifle innovation in the nutrition industry and lead to the removal of many wonderful products. Part of the reason is FDA’s reinterpretation of the 1994 grandfathered list. Any ingredients that are “chemically altered”—such as being modified through milling or lyophilization, or even prepared using CO2 extraction—would be considered new and in need of FDA notification. This could amass a ton of paperwork, given the proposed product-by-product notification process. Companies may be forced to focus on fewer, less innovative products rather than file numerous expensive notifications. Even FDA may have trouble keeping up.

States Paul Dijkstra, CEO of InterHealth Nutraceuticals, Benicia, CA, “The number of submissions resulting from the new guidance could possibly overwhelm the FDA, leaving a back log of submissions and companies putting innovation on hold.”

How could the possible capping of innovation affect suppliers, in whose realm innovation routinely lies? “The supplement industry must innovate to survive,” says Sigalit Zchut, Ph.D., R&D manager of the BioActive Ingredients division at Enzymotec. Ltd., headquartered in Israel with U.S. offices in Morristown, NJ, noting that there can be tension between industry and the regulator. “The new guidance will not harm innovation, as long as the manufacturers of the ingredients or distributors of the food supplement will be responsible and go through the required safety tests to make sure that their product is indeed safe.” These tests are extremely costly, she adds, as we will talk more about later.

Others are not as optimistic. “If this guidance document passes unchanged, the burden on our industry will be extensive,” according to Bob Green, president of Nutratech, Inc., West Caldwell, NJ.

Ron Udell, president and CEO, OptiPure/Kenko International, Inc., Los Angeles, CA, anticipates raw  material suppliers will be reluctant to launch new ingredients, given that their customers will have to come up with the cash and time to go through their own notifications process—and may not be able to. “It will definitely impose an increased burden and expense on raw material suppliers who want to be in compliance with the regulations. These additional costs will most likely be passed on to consumers,” he states. “More NDI notifications would have to be filed, because fewer ingredients would qualify under the FDA’s extremely narrow view of grandfathered dietary ingredients, even if they were once considered as an acceptable raw material with only a minor change made.”

material suppliers will be reluctant to launch new ingredients, given that their customers will have to come up with the cash and time to go through their own notifications process—and may not be able to. “It will definitely impose an increased burden and expense on raw material suppliers who want to be in compliance with the regulations. These additional costs will most likely be passed on to consumers,” he states. “More NDI notifications would have to be filed, because fewer ingredients would qualify under the FDA’s extremely narrow view of grandfathered dietary ingredients, even if they were once considered as an acceptable raw material with only a minor change made.”

Green shares a similar fear: “Will they be willing to go through the bureaucracy every single time they want to use this new ingredient in a formula?”

Steil has already noticed a certain amount of cautiousness, as fewer new product launches seemed to occur in 2011 than in previous years.

Some finished products makers may want to be conservative and only work with ingredients that don’t have NDI issues, says Shaheen Majeed, marketing director for Sabinsa Corp., NJ, East Windsor, NJ, though he makes the point that even this is only speculation. He states, “For now, there is a checklist of items we as a supplier of ingredients are going through; we realize our customers have questions and they have a checklist brewing themselves to make sure they are compliant. As this list gets long, we worry about price points, and we worry about whether or not marketing companies will just play it safe for the next one to two years.”

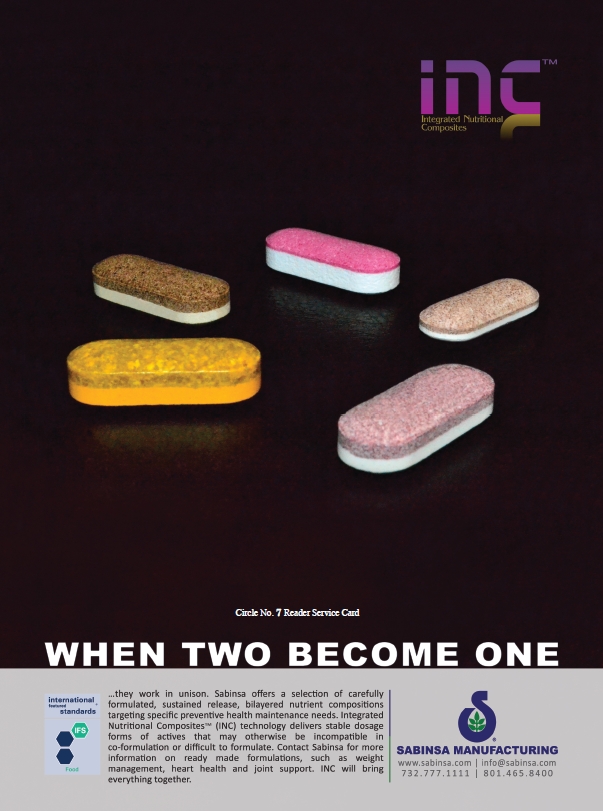

Majeed notes, however, that innovation may turn to novel delivery systems, specifically those that “allow for previously incompatible ingredients to be delivered together, such as with our Integrated Nutritional Composites (INC), which are bi-layered, multi-release nutritional compositions that address specific health maintenance requirements.”

To the issue of innovation, Suhail Ishaq, president of BioCell Technology, Newport Beach, CA, adds another layer. He explains that his company spent many years and much money to  substantiate the quality, safety, efficacy and biological properties of its branded ingredients (like BioCell Collagen and i-Sabi). If the current NDI guidance stands as is, he states, “we fear that in many respects, our innovative effort would be lessened because a finished product containing our ingredient would have to be re-substantiated as a new dietary ingredient, creating redundancy and excessive regulation.”

substantiate the quality, safety, efficacy and biological properties of its branded ingredients (like BioCell Collagen and i-Sabi). If the current NDI guidance stands as is, he states, “we fear that in many respects, our innovative effort would be lessened because a finished product containing our ingredient would have to be re-substantiated as a new dietary ingredient, creating redundancy and excessive regulation.”

Ishaq goes on to say that this duplicative filing “goes against the original spirit and intent of DSHEA, which clearly set the groundwork for the NDI’s as being ingredient specific, not finished product specific. The acronym NDI itself implies this correlation.”

Green suggests that money will factor into manufacturers’ ingredients choices. Companies that take on new ingredients could have additional expectations of suppliers: “They’ll most likely push the cost of the NDIs onto the supplier. The investment in both time and money will be astronomical. The financial impact will be felt all the way down the supply side, as well as the FDA,” says Green.

This scenario is by no means out of the realm of possibility. Finished products makers may soon expect suppliers to have reliable safety and efficacy data at the ready—possibly even negotiating for new, custom studies—that will specifically help them through the notification process. Whichever way things go, we can expect only raw materials makers that back ingredients with reliable data to survive.

Seeing the silver lining, Gunny Sodhi,  director of operations and marketing, Ayush Herbs, Redmond, WA, states, “In the end, what it makes us do as a company is improve our own practices. I see us adhering to a new standard, and out of that standard innovation comes and we can continue to excel.”

director of operations and marketing, Ayush Herbs, Redmond, WA, states, “In the end, what it makes us do as a company is improve our own practices. I see us adhering to a new standard, and out of that standard innovation comes and we can continue to excel.”

Likewise, Mitch Skop, senior director of new product development, Pharmachem Laboratories Inc., Kearny, NJ, believes quality-strong companies, like his, will be attractive to finished products makers. “In our history, any time regulations became more stringent, Pharmachem’s business boomed. Our ingredients, our QA/QC systems and our expert personnel are adept at addressing these challenges,” he says.

This begs a few questions: Which suppliers have such data? And, what are the hallmarks of “good” research?

NDI Experts

As previously mentioned, the majority of all filed NDI notifications have been rejected. Nonetheless, many of the companies interviewed in this piece are among the firms to have successfully navigated the process.

Michael G. Jeffers, president of Helios, Santa Fe, NM, speaks of his company’s experience with the process for its menopause ingredient, EstroG 100. He says the notification process was “tedious.” It took three years, during which time the firm’s data accumulated and got even better. “We have a phase-one trial, a phase-two trial, five toxicity studies, two anti-cancer studies and 19 additional bridge studies,” he states. “Once we submitted this, we were able to get our NDI within the first 75 days…We finally understood what the FDA wanted: that we needed to prove, beyond a shadow of a doubt, that our product is safe.”

Nutra Bridge, says Steil, also jumped the regulatory hurdles of the NDI process multiple times (twice for its 7-Keto and once for Inzitol). He states, “As a company, we have invested in and worked very hard toward discovering, developing, manufacturing and supplying ingredients that comply with regulatory requirements and address the needs of consumers by delivering solid efficacy and safety. It is a long strategy that has worked and continues to grow.”

According to Harwood, Aker’s NDI experience was a “very positive one.” The company compiled the extensive data required for the process and used a consultant to ensure the timely review of the notification.

Sabinsa, too, filed an NDI on its SelenoForce ingredient to meet the regulatory guidelines, and also because customers asked for it. Majeed states, “This may be the case going forward, where our customers may ask that we file for NDI a nd await the results although this will have to be determined on a case-to-case basis due to the financials that are involved and the scope in which NDIs can be used.”

nd await the results although this will have to be determined on a case-to-case basis due to the financials that are involved and the scope in which NDIs can be used.”

Indeed, companies that have successfully navigated the NDIs notifications process have a competitive advantage because customers may want to use their studies (if applicable) to file their own NDI under the new guidelines. States Steil, “In hindsight, [filing an NDI application] was an excellent strategic decision as it is paying off in today’s regulatory environment—we are gaining new customers based on the fact that we have NDIs.”

InterHealth’s UC-II joint health ingredient and Enzymotec’s ingredients are also FDA notified and published NDIs.

Other companies, like Nutratech and Bergstrom Nutrition, sell ingredients that were marketed prior to 1994, and thus have not needed to go through the NDI process.

These firms may need to help finished products makers establish proof of safety and health claims. States Rodney L. Benjamin, director of technical development at Bergstrom Nutrition, Vancouver, WA, “We have documentation on file showing our product was manufactured and marketed prior to October 1994. We did go through the self-affirmed GRAS process, which has an even higher standard than required for NDI notification.”

Research beyond NDIs. Many companies believe research doesn’t stop once the minimum regulatory requirements are met. “Clinical studies are very important to promote dietary supplements; they are important to determine the safety of the ingredients an d are also important to prove the efficacy of the ingredients,” says Zchut.

d are also important to prove the efficacy of the ingredients,” says Zchut.

Indeed, numerous companies interviewed for this report regularly allott funding to new research, regardless of whether they are required to file an NDI or have already gone through the process. Says Steil, “Research is the major focus of our investment as a supplier of unique ingredients. Since our portfolio only includes patented, branded products, heavy investment costs make good business sense as the science can’t be borrowed by other ingredient suppliers…Good science is critical to support the claims of finished products sold by our customers.”

Majeed estimates that 10% of its sales go back into independent research on its ingredients annually. “That number is significant when you consider the percentage decrease in research funding by Big Pharma over the years and relate that to the side effects that people are experiencing,” he says.

“The investment in research can never end,” adds Green. “We fund research projects and provide ingredients for others conducting studies. With our funded research, our scientists work in collaboration with leading researchers from accredited third-party institutions to ensure that each study produces a scientifically valid outcome.”

Bergstrom Nutrition and Ayush say they commit a portion of their budget to research. InterHealth Nutraceuticals, says Dijkstra, heavily invests in tests to ensure the efficacy, safety, purity and potency of its ingredients.

Defining “quality research,” and ensuring research is up to snuff in the eyes of the regulators is another issue to consider. Joosang Park, Ph.D., BioCell’s vice president of scientific affairs, says the gold standard for efficacy is human clinical trials. “The markers of high-quality safety research include both acute and chronic effects of ingredient ingestion on the comprehensive metabolic panel in a human clinical trial setting. Of course, the potential cytotoxicity and carcinogenicity testing needs to be preceded to establish safety,” he says.

The best protocol, says Green, is double-blind, placebo-controlled clinical research studies, of which his company has nine on its branded ingredient (AdvantraZ).

To this, Steil adds that the results must be statistically significant.

But, there’s more to the picture. “As scientists and researchers are always telling me,” says Green, “there are many other valid markers of high-quality research, which are often dictated by the nature of the research itself. So, a single, double-blind, placebo-controlled study—no matter how state-of-the-art—can never be the be-all and end-all in evaluating an ingredient’s safety and efficacy.”

Essentially, Green disagrees with the practice—often undertaken by the media—of condemning or falling in love with an ingredient based on just one study. “Scientists know that it is the body of research—that includes many different study designs—and the collective direction of that research that are the true markers of safety and efficacy,” he says.

Given all these factors, it’s not always clear what FDA and the Federal Trade Commission (FTC) are looking for in terms of quality. Jeffers discusses a few markers: “With FTC establishing a broader cooperative relationship with FDA, it looks like, to us, that when FTC evaluates a structure–function claim on a label, they’re looking for evidence that the claim can be backed up by at least two human clinical studies.” The “quality” aspect gets into the number of participants and the study’s length. “That’s where the real costs come in,” says Jeffers. “The more people you use and the longer the study, the more expensive it is.” Thus, companies that commit to good research also must commit to opening their wallets. “You really have to be conscious of whether you can afford to be in the game of innovation because of the economics,” says Jeffers.

Sodhi describes the efforts undertaken by Ayush to ensure quality research: “A lot of time is spent in R&D with the product, and then cross-checked through other measures, such as third parties, clinical trials and published studies. Then, you can substantiate your claim, and to us that is what really matters.”

Given the economics, one can envision an interesting scenario in which manufacturers and suppliers may end up working out new research opportunities together. Jeffers says his company already engages in something similar. Helios has worked on certain target categories and then focused on specific endpoints in its clinical data. “If there are additional end point claims that are available to us, then, most definitely, that decision is a collaborative decision between Helios Corp. and the end user,” he states.

The Face Behind the Numbers

In research, there’s also the little detail of who exactly is collecting the data and crunching the numbers. Some companies prefer to handle research in-house. Others branch out, or do a combination. “While some of the initial work is done in house, we have worked with excellent, neutral and independent third parties to best assure us of adequate study designs and neutral and unbiased results,” says Skop.

Steil believes in going with a reputable contract research organization (CRO) or university in the United States or in Canada, “as this data is directly applicable to the population that our customers target to sell finished product.”

When Ezymotec partners with a CRO to run the study, “we are fully engaged in every aspect of the study, from planning through the selection of study centers, the recruitment and throughout the intervention, the completion etc.,” says Zchut.

Also looking to universities for research help is InterHealth Nutraceuticals. Research on this firm’s ingredients, Dijkstra says, “are designed, conducted and published by well-reputed researchers at leading universities…Safety research is conducted in GLP-approved labs. Our ingredients undergo genotoxicity research, subchronic toxicity research, acute oral and dermal toxicity and primary dermal and eye irritation testing. Analysis of adverse events in humans is undergone in randomized, double-blind, placebo-controlled research…The efficacy of InterHealth’s ingredients is backed by randomized, double-blind, placebo-controlled research.”

When all is said and done, Udell feels the data should be made public on a company’s Web site or another accessible place.

Standing Shoulder to Shoulder with Manufacturers

Although the draft NDI guidance places the burden on finished products makers to comply, once the NDI guidance document is finalized, we may see suppliers playing a role in helping their customers comply. In terms of working together, Majeed advises everyone to first be patient. After all, when the document is released—which could be months, or even years from now—it will be new to everyone. “There are a number of items that both the supplier and the finished product makers, even the contact manufacturer, have to u nderstand and agree to.”

nderstand and agree to.”

“From a logistical standpoint, manufacturers will have to push this responsibility down to ingredient suppliers and require them to supply evidence of marketing prior to October 1994 or provide the necessary safety and toxicity data in their Standardized Information on Dietary Ingredients (SIDI) forms,” says Green.

Under the new guidance, finished products makers can make strong reference to the original NDI notification that a supplier has filed. Marketers wouldn’t have to redo the science unless they chemically modify the ingredient further. If supplier never gets an NDI, the finished product maker has to take the responsibility. You can see the appeal of a supplier with an NDI.

Skop believes the key is “transparency, transparency, transparency.” Information about plant-derived materials must be made available, “right down to the seed, to the soil in which the plant grew,” he believes.

Majeed agrees, stating, “Whether it’s by e-mail or face-to-face, let’s make sure all documents—whatever is available to satisfy the guidelines as best as possible—are made available. Suppliers will be asked for proof, and this can be in various formats. From the onset of a project, it should be discussed what proof is available and make sure everyone is comfortable with that.”

Sodhi says once suppliers learn more about the document, they can help customers lead the way toward compliance, saying, “Educate them on the guidance, and openly communicate what the company can and cannot do as per the guidance.”

Likewise, Benjamin of Bergstrom Nutrition believes suppliers can help by having ingredients properly classified and documented. “Make sure you have a consistent and controlled process so the product they purchase is consistent, properly classified and documented,” he states.

Perhaps most important, suppliers of new ingredients should continue filing the right regulatory paperwork and also “making sure that the ingredients are regulated to a wide range of concentrations so different formulations will fall under the same regulatory file,” Zchut says.

Adds Jeffers, “We need to do what we have been doing: provide them with extensive data, which includes our clinicals and our safety studies....the better our data the better their structure–function claims. That’s our commitment; to provide that information so they have the confidence and the legal context to make those claims.”

In the end, suppliers had better be gearing up with technical support to meet the needs of their customers. WF

Reference

1. Council for Responsible Nutrition, “FDA Draft Guidance on New Dietary Ingredients for the Dietary Supplement Industry,” www.crnusa.org/pdfs/Backgrounder_NDIN_FINAL_9-29-11.pdf, accessed Nov. 30, 2011.

Published in WholeFoods Magazine, January 2012