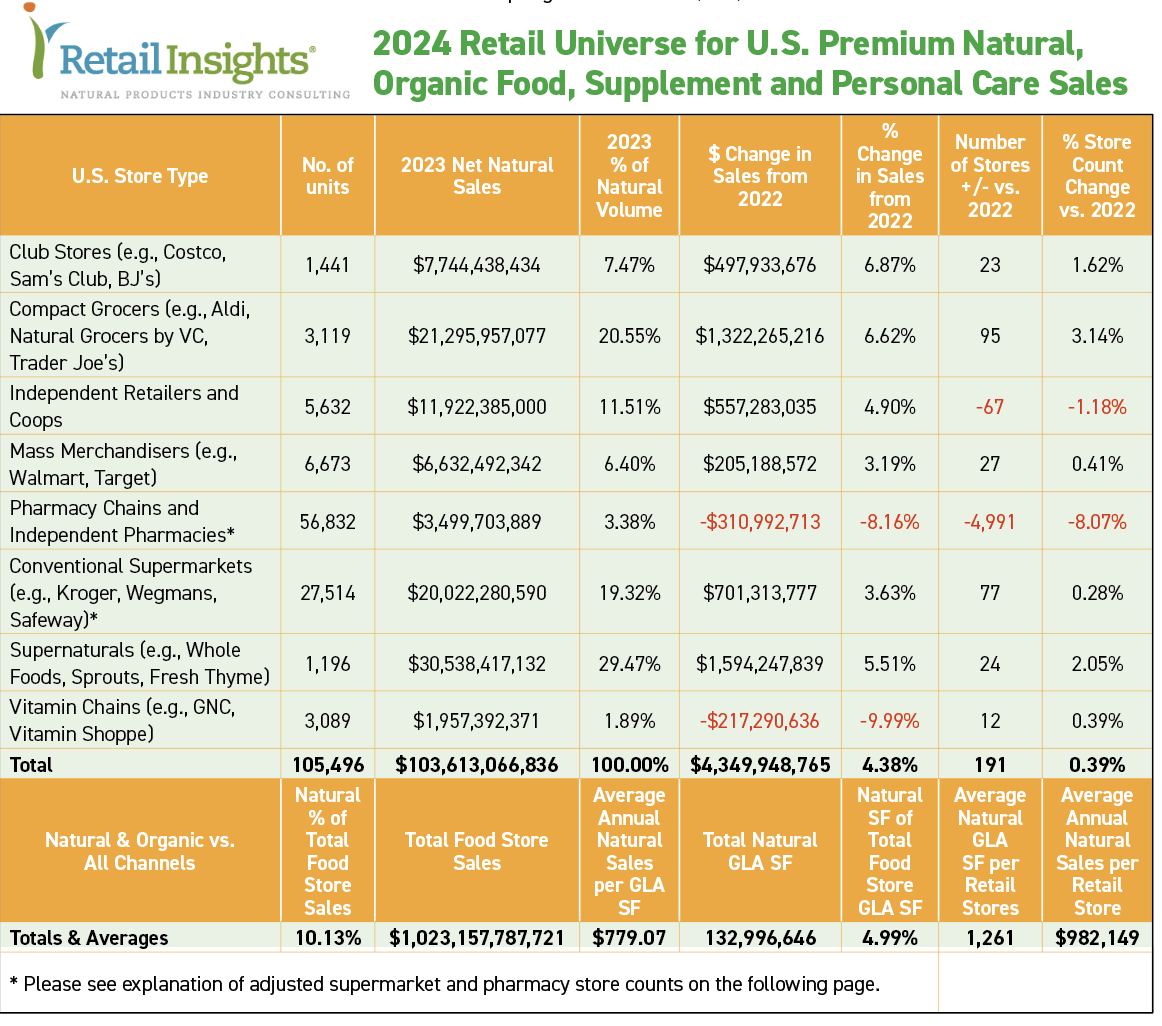

U.S. natural organic retailers had strong growth this year in six of the eight U.S. retail channels we track in the Retail Insights® Universe. Only pharmacy chains, independent pharmacies, and vitamin chains suffered sales declines.

Natural organic retail sales reached $103.6 billion, up $4.3 billion from last year’s $99.3 billion, a 4.38% increase. Altogether, natural organics make up 10.13% of the $1.023 trillion we are estimating for total U.S. food-store sales.

Natural organics achieved several records this year, including average annual sales per gross-lease-area (GLA) square foot of $779.07; 1,261 gross-lease-area square feet per store, and average annual sales per store of $982,149.

Overall, we are tracking 105,496 stores that sell natural organic products in eight retail channels (see table below). Here is our breakdown of this year’s channel results:

Supernaturals – No. 1

Once again, large supernatural grocers including Whole Foods Market, Sprouts, Fresh Thyme, and others led the natural organic field, adding $1.59 billion in sales—up 5.51% to total $30.5 billion—and topping the natural organic food sector with 29.47% market share.

Whole Foods’ parent company, Amazon, stays mum about the chain’s particular results, perhaps because in-store sales haven’t grown significantly since its 2017 acquisition. We estimate Whole Foods’ U.S. brick-and-mortar sales at just over $18 billion this year.

Amazon does not count Prime online orders as part of Whole Foods’ sales, but we do, and are carrying $2.85 billion in virtual orders we believe come from the chain’s U.S. physical store inventory. Altogether, our estimate of Whole Foods’ U.S. in-store and online sales are $20.85 billion, by far the lion’s share of supernatural-channel sales. The chain added two stores this year, bringing U.S. unit count to 515.

Supernatural Sprouts follows with $7.06 billion in sales, up a robust 9.6% year over year, made up in part by a 5.5% increase in store count, up 21 units to 401. West coast chain New Seasons-New Leaf Community Markets and Midwest chain Fresh Thyme place third and fourth, respectively, with sales nibbling at but not quite reaching $1 billion each. We estimate New Seasons- New Leaf’s growth in double digits this year, and Fresh Thyme up about 5%. Altogether, supernaturals added 24 stores this year, up 2% to 1,196 units.

Compact Grocers – No. 2

Since 2012, we have classified food markets of up to 20,000 square feet as “compact grocers,” which we believe will continue to flourish due to their easier-to-site real estate compared to larger conventional supermarkets. The channel added 95 stores this year (87 of which were hard-discounter Aldi locations) to total 3,119 compact grocers overall, up 3.14% units. Total channel sales were $21.3 billion—an increase of $1.3 billion and 6.62%—placing compact grocers second in overall natural organic market share of 20.55%.

Trader Joe’s leads compact grocers, contributing $16 billion to channel sales, with a 5.4% increase for the chain. Several years ago, we added Aldi to the compact grocer channel due to its boldly adding higher quality natural organic products. We estimate 20% of Aldi’s sales are natural organic, good for $3.8 billion, and second place among compact grocers. Natural Grocers by Vitamin Cottage, at $1.14 billion, ranks third, growing a respectable 4.7% this year.

As we go to press, Aldi disclosed plans to complete its acquisition of Southeastern Grocers in the first half of 2024. Southeastern owns about 400 Harveys and Winn Dixie stores, which will boost Aldi’s store count 17%, to about 2,757.

Conventional Supermarkets – No. 3

Close on the heels of the much smaller compact grocer sector, conventional supermarkets added $701 million natural organic sales this year—an increase of 3.63%, to reach $20 billion total—and a third place overall at 19.32% natural organic market share. Throughout the year, chains including Kroger, Safeway, and other supermarkets reported that stressed-out shoppers are cutting back on the number of items they place in their baskets to help combat inflation. But shoppers did not appear to abandon the natural organic products they prefer to keep in their cupboards.

Overall, conventional supermarkets added 77 stores, or 0.28%, to reach 27,514 total units. Please see the addendum section on the following page, which explains how we adjusted the number of supermarket units that we are carrying in the Retail Universe this year.

Independent Natural Retailers and Coops – No. 4

Here, you will read results for WholeFoods Magazine's 46th annual survey of U.S. independent natural retailers and coops. We are pleased to report independents grew an encouraging 4.9% this year, adding $557 million to reach $11.9 billion, and securing a fourth place overall natural organic market share of 11.51%.

As we’ve seen in recent years, the independent channel is gradually losing stores, shedding 1.18%, or 67 units in the past year, ending with 5,632 stores. Nevertheless, growth in the remaining stores overcame this loss. We observe it is the smaller, weaker stores that are closing while larger, stronger independents remain profitable and able to grow.

Club Stores – No. 5

Club stores such as Costco, BJ’s Warehouse, and Sam’s Club enjoyed the highest percentage natural organic growth of any channel this year, up 6.87%, or $498 million, to reach $7.7 billion in sales. This gives them a fifth place, 7.47% overall natural organic market share. Store counts rose 1.62% or 23 units, to 1,441 total. Seventeen of these new stores were Costco units.

Costco by far dominates club channel natural sales, with an estimated $6.6 billion total, making up $477 million of channel growth this year, representing a 7.76% increase in natural sales for the chain. Throughout the year, Costco management cited fresh organic foods driving overall corporate growth.

Mass Merchandisers – No. 6

Mass merchants Walmart and Target turned in a respectable 3.19% increase in natural organic sales this year, up $205.1 million to reach $6.6 billion, securing a sixth place, 6.4% natural market share. Unit counts increased 0.41%, or 27 stores, ending the year at 6,673 big-box stores.

Growth across the channel was lumpy, however, with Target struggling after stubbing its toe midyear in the culture wars. The retailer shed an estimated $29.2 million in natural organic sales, down 1.6%. Walmart more than made up for this hiccup with its roughly 4,700 stores adding an estimated $234.7 million in natural organic sales.

Pharmacies: Chains and Independents – No. 7

This year, we are carrying 4,991 fewer pharmacies in the Universe than last year. The National Community Pharmacists Association is reporting 19,479 independent pharmacies, which is 3,921 fewer than we were carrying. Also in the last year, Rite Aid closed 400 stores, CVS closed 252 stores, and Walgreens closed 97. By our estimates, there were also 321 fewer pharmacies in mass market and conventional supermarkets, bringing the total units we are carrying in the Universe to 56,832.

Natural organic pharmacy sales, made up mostly of vitamins and supplements, fell $311 million, or 8.16%, compared to last year. This year’s total $3.5 billion in pharmacy natural organic sales gives the channel a 3.38% natural market share, for seventh place overall.

Vitamin Chains – No. 8

The Vitamin Shoppe and GNC have consistently been reducing their retail presence for years. This year The Vitamin Shoppe closed five stores, and Vitamin World shut two, bringing unit totals to 694 and 59, respectively. We believe GNC gained a net of 19 stores, converting some franchise locations to corporate units, bringing its total store count to 2,336.

Overall, the channel has 3,089 stores, up 12 units (0.39%). This increase wasn't enough to raise overall vitamin chain sales, though, which we estimate at $1.95 billion, down $217.3 million year-over-year.

Summing Up

Surpassing $100 billion for the first time while adding more than $4 billion in sales, the natural organic sector of the food business is alive and well. Six of the eight channels we track in the Retail Insights Universe delivered overall natural growth of 4.38%, exceeding the typical 3% growth rates reported by conventional foods retailers during the past 12 months. Even though consumers reported stress from dealing with inflation, particularly acute for groceries, households continued to embrace natural organics as part of a healthier, more resilient lifestyle.

Reconciling Food Store Sales

The Food Marketing Institute (FMI) is reporting sales of $1 trillion from 45,575 U.S. supermarkets as of 2024. We believe this represents all food categories but does not include sales of non-food categories from these retailers. For example, Walmart, a mass market-channel retailer FMI includes in its definition of “supermarkets,” had $421 billion in U.S. total sales, of which 55%, or $231 billion, were from food. For 2024, we are estimating $1.55 trillion in total food and non-food sales from stores in all eight retail channels we are tracking in the Universe: $1.023 trillion from foods and $531 billion in non-foods.

Natural Square-Foot Efficiency

The $103.6 billion in natural organic sales represents $779.07 in annual sales per the 133 million natural square feet we are carrying in the Universe. The $1.55 trillion in food and non-food sales represents $583.26 annual sales per total 2.66 billion retail store square footage, making natural products one-third (133.57%) more efficient per square foot than the overall average.

Addendum: Updating Supermarket Counts

In 2024, NielsenIQ TDLinx and the Food Marketing Institute (FMI) updated U.S. supermarket store counts to 45,575 units. In addition to conventional supermarkets, Nielsen/FMI's definition of “supermarket” includes stores in five of the eight channels we track in the Universe: club stores, mass merchandisers, compact grocers, supernaturals, and independent natural food stores and coops, which this year make up 18,061 stores we are carrying in the Universe.

Previously, we had not deducted these stores from the total supermarket channel store count. This year, we deducted these 18,061 stores in these five channels from the 45,575 total supermarket store count, leaving a net 27,514 conventional supermarkets we are carrying in the Retail Insights Universe for 2024. This adjustment allows us to more precisely apportion conventional supermarket food sales and food sales in the seven other channels in the Universe.