Niche? No way. The appeal of plant-based just keeps growing. Research from Sprouts Farmers Market determined that nearly half of Americans consume more plant-based than meat-based meals, with 54% of respondents ages 24 to 39 identifying as flexitarians, and 63% of respondents saying they’d be willing to swap meat for a plant-based alternative (2). Climatarian, flexitarian, pescatarian, or simply cutting back on meat...whichever approach your customers follow, successfully merchandising the section in store can help them—and you!—succeed.

PCC Community Markets has been selling plant-based proteins for years. Recently, the Pacific Northwestern-based co-op has seen a change in the plant-based target audience, says Scott Owen, PCC Senior Grocery Merchandiser. “The traditional products that stores like PCC have carried are more geared to vegetarians and vegans, plus your occasional plant-based eater. The new generation of products is much more targeted to those wanting to ‘cut back’ on meat from time to time.”

Across the country in Pennsylvania, Weavers Way Co-op, WholeFoods Magazine 2020 Retailer of the Year, is constantly replenishing plant-based offerings. “More items are being added weekly, including products from local vendors, like vegan cheeses, nut butters, and refrigerated grocery items,” says Kathleen Casey, Development Manager, Weavers Way. The co-op has a strong following of customers that purchase hyper-local items, including burgers made with black and garbanzo beans from Luhv Foods, as well as Eat Nice vegan ravioli.

Placement In-Store

There has been debate for years over the most effective placement for plant-based protein. Christopher Morini, Creator/Co-Founder of Morini Brands, maker of Risofu and Spread Instead, has over 30 years of experience merchandising plant-based. In the mid 90s, Morini was among the pioneers of the vegan/vegetarian plant-based sections with Kroger and Publix. Since that time, he says the industry has experimented with plant-based food products in just about every corner of the stores.

In an effort to see what works best with shoppers, in 2019 Food Marketing Institute (FMI) asked consumers where they prefer to see plant-based meat alternatives in the grocery store. The responses were mixed: 26% said the produce department; 37% said the meat department; and 37% said the frozen aisle (3). For a detailed take from a flexitarian and an ethical vegan, check out “Positioning Plant Protein: What’s the Best Placement?” on www.WholeFoodsMagazine.com (4).

Within the industry, there are also varying opinions. Morini thinks separation is necessary. “I’m not a fan of marketing/merchandising for example plant-based ground meat in the meat department next to animal meats. A true long-term commitment to the plant-based space seems always in flux and plant-based alternatives are too easily rationalized for changes or deletions. It’s my firm belief that plant-based foods need a permanent destination so the consumer can easily find them and see new arrivals as well as the stores fully committing to its success.” His stance: “It’s time for natural stores and conventional supermarkets to have major signage that clearly marks sections for plant based refrigerated, frozen and dry plant based just like Meats, Bakery, Deli, Produce, and the like, have theirs.”

A different take comes from Ron Bryant, Chief Growth Officer, No Evil Foods, who thinks plant-based should be mixed in with meats for more visibility. “Natural products retailers should create a destination for plant-based alternatives adjacent to the existing categories that they complement. With adjacent positioning, these consumers can easily find Plant-Based alternatives and compare them to animal-based products they might normally purchase.”

Expressing similar: “Most retailers combine both plant- and dairy-based milks in the same space and regardless of the origin; our view is that plant-based sales will be maximized if the category is treated as one, versus asking consumers to shop in two different locations,” says Jim Richards, CEO of milkadamia. He adds that keeping plant-based at eye level with shelf tags is a recipe for success.

Sales increase when products are merchandised based on how consumers navigate through the store, agrees Kevin McCray, Founder, Kevin’s Natural Foods. “I find our products do best when retailers integrate them into the category they belong and then highlight them as plant-based with a shelf tag that shoppers can easily identify throughout the store. This approach can be amplified with limited-time merchandising vignettes that showcase complimentary plant-based items on dedicated end-caps and/or refrigerated cases to drive additional trial and promotional excitement.”

Chris Pruneda, Chief Marketing Officer of Koia, a functional plant-based beverage brand, reports that the company’s products are placed all over the map, from dairy to produce and functional beverage sets. “Plant-based beverages are still a relatively new category tested in retail, so we’ve had an incredible opportunity to work with our retail partners and try different merchandising strategies,” Pruneda says. “We’re most featured and perform best in the functional/better-for-you beverage sets, but also perform well in the produce section and occasional dairy sets.”

Ashley Collins, Brand Manager, Path of Life, adds, “We’ve seen success in our positioning both behind the freezer door as well as in a frozen bunker. Our packaging is bold and bright so we stand out—whether it’s behind frosted glass doors or in an open-air freezer.”

In PCC stores, items such as tofu and tempeh are placed within refrigerated cases, and plant-based meats in the frozen section are placed with other plant-based products. PCC also cross-merchandises non-meat burgers in the meat case to make them easy to find for explorative meat eaters. The key, according to Owen: “Make them easy to find and realize who the end customer is. We find many purchases happen when someone is having a get-together and wants to make sure they are inclusive of all their friends’ dietary needs, and the rest are folks truly attempting to cut back on meat.”

When it comes down to it, each retailer knows their customers best—and that will help with merchandising. And of course, each store is different because of the population it serves and the square footage it has to work with.

In small stores, there may not be room for an entire plant-based section, so finding space wherever available is the reality. “Retailers should watch very carefully on what’s moving from the shelves and pay close attention to their customers,” advises Bob Goldberg, Co-Founder and CEO of Follow Your Heart, a brand that has been in the game since before vegan was even a commonly used word. “Listen to what they like and what they complain about. It’s a treasure to have that kind of contact. For the small store, pay close attention to what customers are asking for. Make sure you’re not wasting shelf space on things that aren’t selling.”

As plant-based interest increased, Weavers Way’s largest store took refrigerated shelving space previously occupied by its meat and seafood department and filled it with plant-based proteins. “The visibility of these items have increased dramatically,” Casey adds, “and as a result people who have not been traditional seekers of vegan items will add them to their basket.”

Smaller stores may want to consider doing the same. “The best way to merchandise and market plant-based foods is in as many places as possible throughout the store,” says Katherine Franklin, Vice President of Product & Marketing at Follow Your Heart. “Consumers are looking in all aisles of the store to find plant-based options, so the best way to increase sales is to increase the overall shelf-space dedicated to plant-based. We often hear that dedicated plant-based shelf-space is limited, but we overperform in the individual slots we hold, and if retailers increase the shelf space available for plant-based versus multiple facings of dairy options, we anticipate overall sales gains for everyone.”

Again, call-outs and any extra visuals that help consumers navigate towards plant-based products will make a meaningful difference. “We recommend making it easy for consumers to recognize the plant-based options that fit their lifestyle and to quickly understand the benefits they offer,” says Gael Orr, Director of Marketing, Once Again Nut Butter. “When merchandising nut butters, for example, call out that they’re a good source of high-quality, plant-based protein, plus are rich in healthy fats, vitamins and minerals. Seed butters provide an allergy-friendly pantry solution as well.”

Another key to plant-based success: employee education. “The amount of misinformation among team members is largely due to the lack of intentional education,” says David Janow, President & Founder of Axiom Foods. “Assumptions are made that either information about ingredients isn’t important or retail team members are adequately self-educated. This is a missed opportunity for our natural products industry to help distribute accurate information to consumers at the retail level.”Plant-based is so much more than burger alternatives, says Casey McCormick, Director of Product Development, Sweegen. McCormick is seeing plant-based offerings gaining traction across the entire spectrum from food and beverage to alternative dairy and even alcoholic spirits.

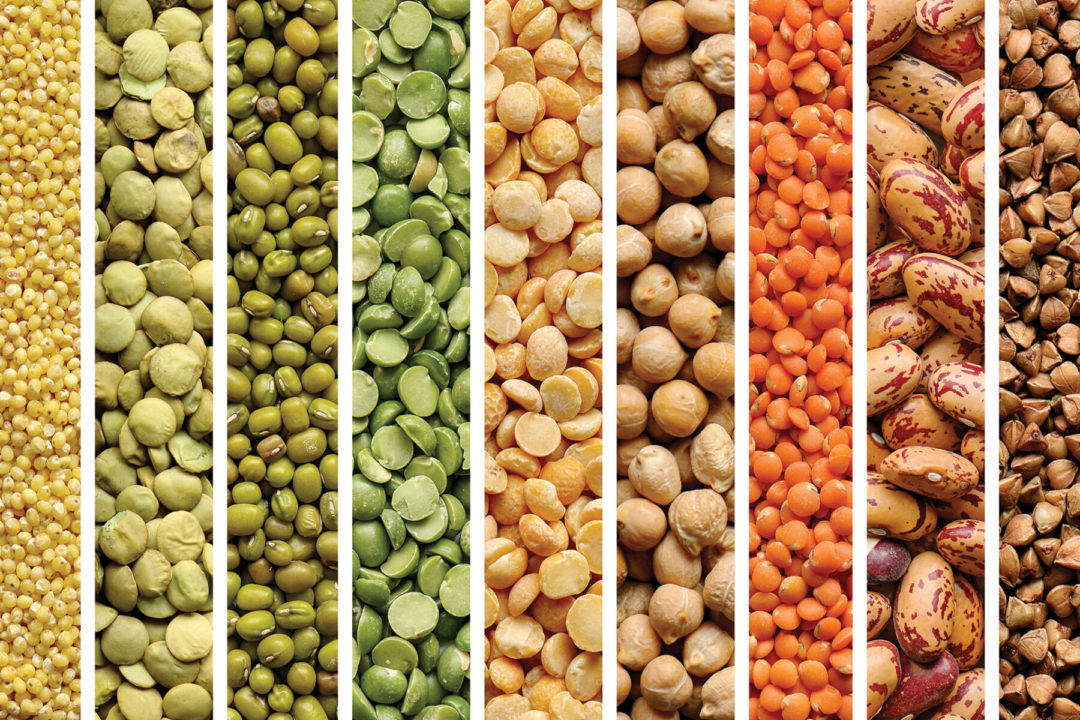

Trending plant-based ingredients include: sunflower, mung bean, potato, duckweed, navy bean, algae, and seaweed, says Diana Munoz, Associate Manager, Marketing and Business Development, Protein Isolates and Concentrates at Ingredion Incorporated. Food scientists, she notes, are looking for plant sources that are high in protein, scalable, and require a minimal ground use.

Demand shows no signs of slowing. In September 2020, Ingredion opened a new plant-based protein manufacturing facility in Nebraska and has made $185 million in investments to expand its portfolio of plant-based proteins.

David Janow, President & Founder of Axiom Foods, agrees that there’s a tremendous push for plant-based protein—and ingredient science in the category is just at the tip of an iceberg. “Proteins and milk-alternative ingredients have permeated almost every grocery aisle in the past couple years, far beyond the shelf-stable milks and nutrition aisles where they first began,” he says. “From snacks, beverages, meats and dairy, to frozen desserts and meals, plant-based and ‘Free From’ labels are popping up with plant proteins and milk-alternatives because they can and they should.”

Innovation behind these ingredients is making them increasingly functional and neutral in taste and smell. Janow says this means shorter, cleaner, more sustainable, and allergen-friendly labels that especially drive millennial purchases.

Alternative proteins like pea, oat and rice are having a moment, particularly because of their seemingly endless possibilities, Janow adds. “One pea protein ingredient that is extruded by a machine to have the appearance and texture of ground meat can help replace multiple, unfamiliar ingredients in next-generation faux meats. Another pea protein ingredient can replace some gums helping make non-dairy ice creams creamier and more nutritious. One certified whole grain oat dairy alternative ingredient can replace some oils, gums, and fortified nutrients in next-generation yogurts, milks, and more. One rice protein ingredient can replace some flour to give high-protein, low-carb claims to breakfast foods.”

And we can’t forget traditional pioneers of the industry, like soy, says Itay Dana, VP Sales and Business Development, ChickP Protein Ltd. “The traditional ingredients in the alternative proteins continue to grow, but consumers and food companies are still looking for additional solutions with more sustainable, nutritional, and functional characteristics.”

Of course, plant-based sweeteners like stevia are in high demand too, McCormick adds. “Stevia plays a key role in delivering the mainstream taste that consumers love, while also allowing brands to keep their promise of good health to their customers by keeping the sugar out.” Sweegen’s affiliate, Blue California Flavors & Fragrances, created a Destination Flavors portfolio for hard seltzer and spirit products, featuring natural and clean true-to-fruit flavors that are indigenous to world locations, such as Catalan Crush (the flavor of peaches from Spain) or Aruba Ariba (the flavor of vibrant tropical fruits of the Caribbean).

Also key: that the health benefits of many alternatives are abundant. Janow explains, “As the amino acids in proteins are the building blocks for our bodies, their health benefits go far beyond just muscle-building. When added to high-carb foods, protein can help manage blood sugar spikes. When combined with fiber, protein can help curb hunger. Plant proteins are even part of the formula for building antibodies.”

Kevin Ohashi, Ph.D., CEO, Phenolaeis, points to the company’s Palm Fruit Extract as an example of a new superfruit botanical that checks the boxes with both formulators and consumers. Those boxes, according to Dr. Ohashi: No matter what the ingredient is, as the innovation continues, ingredients need to aim for taste, scalability, sustainability and formulation performance.Trendspotting

Chickenless eggs, plant-butters, oat-everything...the innovation of plant-based is abundant. One thing that remains constant: protein, low sugar, and wholesome ingredients are key to persuading the veg-curious to take a taste adventure and sample new products.

“Whole food plant-based is coming into its own and there is more innovation in this space for foods that are minimally processed with very few ingredients that are also tasty and convenient,” says Elysabeth Alfano, Founder of Plant Powered Consulting, host of the Plantbased Business Hour and Managing Director, North America of Vegconomist—the vegan business magazine. She says hemp seeds and products that offer fiber, protein and omega-3s are having a moment. Ashley Collins with Path of Life would agree. Protein is a big consideration for consumers seeking plant-based options—specifically products with quinoa.

Jessica Cording, MS, RD, affiliated with Kamut Brand khorasan wheat, notes that the wheat contains 13.5g protein and 10.3g fiber per half-cup of uncooked wheat, as well as iron, B vitamins, and selenium. “As a nutrient-dense grain, Kamut brand khorasan wheat, is an excellent way to ensure that you’re covering your bases when enjoyed as part of a balanced meal,” Cording said in a press release from Kamut. “It’s simple to prepare, easy to store, and is available all year long.”

“Consumers are actively seeking products made from nutrient-dense and protein-rich, whole foods like Once Again’s nut and seed butters,” adds Orr. Once Again’s Nut Butters are made with simple ingredients, are free of cholesterol and lean into trendy flavors like maple, hemp, and sunflower.

Convenience remains a priority. “We are seeing an increase in demand for quick-to-prepare plant-based entrées,” says McCray. “The meat industry has been great about innovating with pre-cooked meats, marinades, meal starters, and prepared entrées. To us, it made sense to focus on these needs for plant-based meal solutions.”

Meals like better-for-you frozen pizzas, heat-and-eat entrees, meal kits and indulgent meals like vegan macaroni and cheese, and plant-based snacks like varying jerkys are popular, says Natalie Slater, Marketing Manager with Upton’s Naturals.

In the name of convenience, retailers are making filling up on plant-based foods easier than ever. “Our prep foods department has increased its offerings in plant-based foods,” says Casey of Weavers Way. “Special holiday meals that we offer now include a vegan version.” As an example, the retailer offered a vegan version of a Shepherd’s Pie merchandised next to a traditional version. “We also have added a number of vegan grab-and-go items for everyday shoppers.” WF

Nature Made Makes Waves With Pickle-Flavored Gummies

April 15, 2024