The supernatural Earthfare, which had declared bankruptcy just as we went to press last year, reopened 18 of its 49 stores under new ownership in 2020, but is still down 31 units.

The supernatural Earthfare, which had declared bankruptcy just as we went to press last year, reopened 18 of its 49 stores under new ownership in 2020, but is still down 31 units.Fairway and Fresh Thyme closed 8 stores each in 2020, and now operate 6 and 69 units, respectively. Sprouts Farmers Market is growing, operating 356 stores in 2020, up 21 from 335 last year, and Whole Foods added 15 U.S. stores, to reach 502 units in 2020. Whole Foods also has 14 Canadian units, and 7 stores in the UK, which we don’t count in Retail Insights’ U.S. Universe.

Amazon is being coy, lumping in Whole Foods total 523 stores with its 57 other non-Whole Foods “physical stores,” and does not break out Whole Foods’ results. We don’t want to say the internet behemoth is embarrassed about Whole Foods’ performance. But all of Amazon’s 580 physical stores sold $16.2 billion in 2020 according to the company, so it is useful to remember that in 2017, the year Amazon acquired it, Whole Foods’ U.S. sales—alone—were $17.3 billion.

Amazon is experimenting with food-store formats, “branching out from Whole Foods,” according to Amazon Director of Investor Relations, Dave Fildes. Five large Amazon Fresh stores at 35,000 square feet; 26 much smaller Amazon Go stores—1,800 square feet on average, with “Just Walk Out” no-touch technology; and two new Amazon Go Grocery stores, at a mid-size 10,400 square feet. Altogether, we estimate sales at Amazon’s 57 non-Whole Foods stores, plus the 21 non-U.S. Whole Foods stores are $619.7 million, which leaves $15.6 billion exclusively for Whole Foods’ U.S. stores in 2020.

It is apparent that sales in the physical Whole Foods stores have declined. Offsetting this are online sales. A casual walk past most Whole Foods stores reveals multiple Amazon Prime sales order-pickers at the curb, loading hundreds of Prime grocery bags into waiting delivery vans. We’re willing to say a good portion of what would have been Whole Foods’ growth in-store has shifted online, and we are crediting Whole Foods’ U.S. online sales with $2.6 billion, bringing its in-store plus online total to $18.2 billion in 2020.

Due in large part to this softening in Whole Foods’ physical stores sales, we believe we will not see the same pace of new-store openings in the future, and that the 2020 increase of 15 U.S. units is an artifact of the lease pipeline that was in place before and shortly after Amazon acquired Whole Foods. Why pay the premium real estate costs for a declining physical asset?

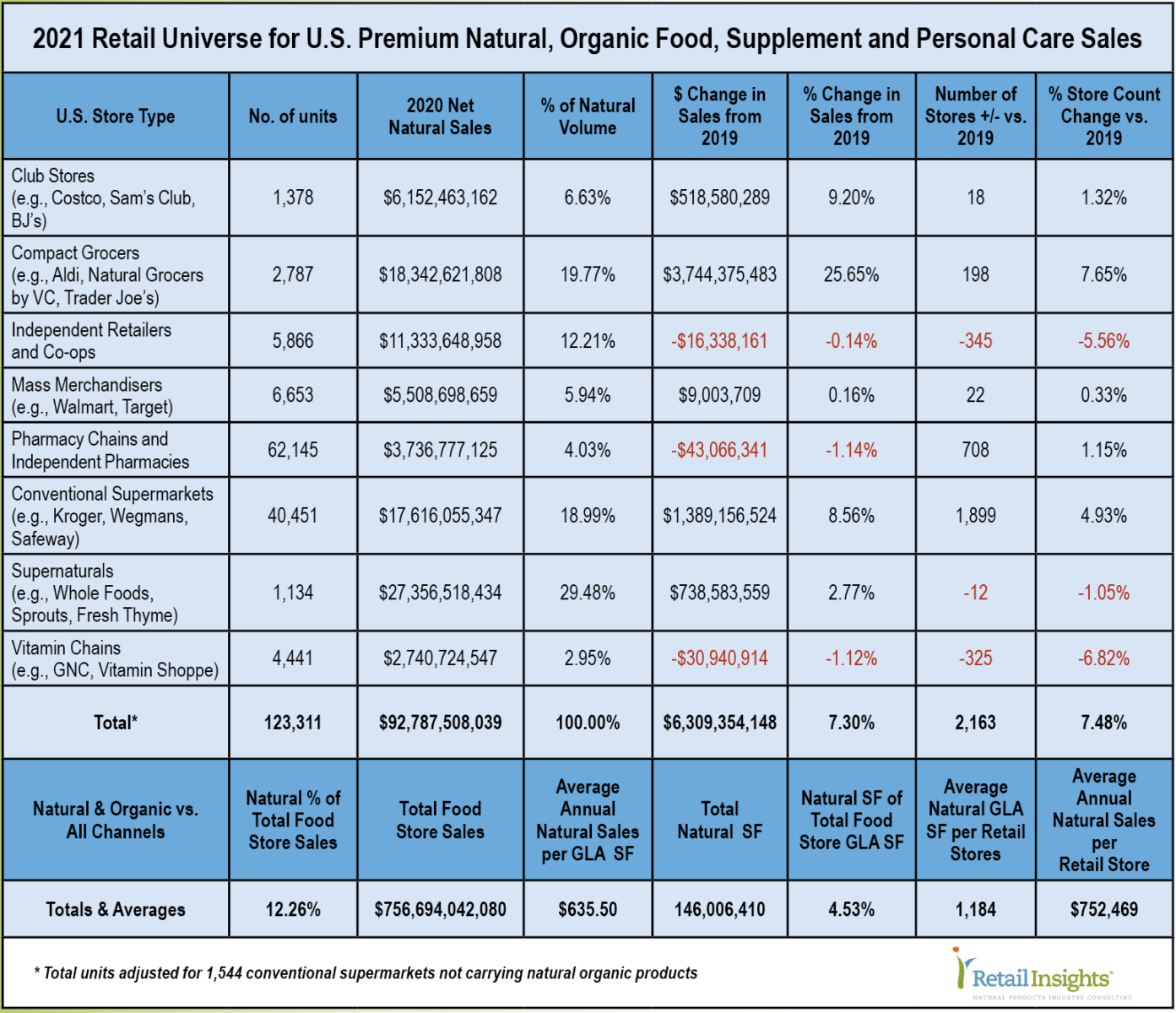

In the No. 2 natural spot, compact grocers—stores up to 20,000 square feet gross lease area—had a whopping year in 2020. You may remember, last year we added hard discounter, Aldi, to this category because its increased organic assortment is definitely on the sales radar screen. Aldi added 163 stores in 2020, reaching 2,073 units. Trader Joe’s added 27 units, to total 530, and Natural Grocers by Vitamin Cottage added 6 to reach 159 units. Altogether, the compact grocer segment added 198 units and, aided by the pandemic-driven shopper rush to quality and immunity, grew natural organic sales by $3.7 billion to $18.3 billion, capturing a 19.7% natural market share, and edging out conventional supermarkets’ natural sales for the first time.

Natural Grocers’ CEO, Kemper Isely, cited the company’s “Feed Your Family of Four” campaign, which provides simple recipes and shopping lists for “healthy, tasty meals under $16,” as gaining traction with shoppers. Isely also noted that Instacart sales represent about two percent of the company’s total sales.

Conventional supermarkets including Kroger, Safeway, Wegmans and others, hold third-place, at 18.9% natural market share, adding 8.6%, or $1.4 billion, to reach $17.6 billion in natural sales. These large grocers obviously benefited from pandemic-driven purchases of natural organic foods and supplements. In addition, the consumer shift from eating food-away-from-home—as restaurants across the country shut down—to the upsurge in cooking and eating food-at-home, drove dramatic same-store sales increases for conventional supermarkets, far beyond any year-over-year increases during the last decade or more.

Online sales for most large conventional supermarket chains grew rapidly as a percentage increase, but still account for only mid- to high-single digits of overall sales. In a caution for smaller retailers considering adopting the array of online services, Albertson’s CEO, Vivek Sankaran, noted that putting all ecommerce transactions together, including delivery and pick-up, “is a breakeven business.” According to Sankaran, in order to reach profitability, Albertson’s will first have to invest in fulfillment infrastructure—meaning new warehouses. Smaller operators, without the critical mass of thousands of stores, may never be able to reach ecommerce profitability.

This year, we’ve adjusted our model for conventional supermarkets, updating store counts to 40,451, from 38,307, 96% of which now carry measurable amounts of natural organic products. Altogether, the higher store-count, plus the increase in COVID-driven stock-up and food-at-home sales, gives the conventional supermarket channel $756.7 billion in total sales, by our measure. This is the figure against which we tally the $92.8 billion in total U.S. natural organic sales to reach 12.26% natural market share of total food-store sales.

In fourth place, independent natural retailers and co-ops achieved a 12.2% market share of all natural products. (Please see theWholeFoods Magazine’s 43rd Annual Retailer Survey of independents’ 2020 results.) While independents shut over 5% of their stores in 2020, down 345 units, the pandemic drove a 5.02% sales increase in the surviving stores, resulting in nearly flat results, down less than 1% (-0.14%), holding steady at $11.3 billion.

As in years past, there’s a big gap between the top four natural channels and the rest of the pack, starting with the club-store channel. Like food stores in the other channels, Costco and Sam’s Club did very well in 2020, propelled by the shift to food-at-home, and by pandemic sanitization and stock-up behaviors. This group added $518 million in natural sales, a 9.2% increase, to $6.2 billion, and captured a fifth-place 6.6% natural market share.

Mass merchandisers Walmart and Target grew their overall sales, enjoying the accelerated increase in same-store sales driven by the pandemic. But these mainstream product sales did not carry over to the natural organic segment, leaving mass merchandisers a sixth-place total natural market share of 5.9%, down slightly from 6.4% last year, at $5.5 billion in both years.

The battle in this segment is for the mainstream consumer, with Walmart opening its online store to third-party sellers, and leveraging its 4,000 U.S. locations to make rapid same-day deliveries to a majority of U.S. households. All of this effort is focused on, as you would imagine, competing with Amazon. Walmart also is burnishing its green credentials, with CEO Doug McMillon saying Walmart wants to be a “regenerative company,” and setting a target date of 2040 to be zero emissions in its operations and fleet, without relying on carbon offsets.

Pharmacy chains and independent pharmacies maintained their seventh-place finish, with natural market share drifting down to 4.0% from 4.4% last year. Sales remained flat, down $43 million, or (-1.1%), at $3.7 billion in both years.

Drawing last place, as in prior years, the vitamin chain channel continues its long, slow bleed, hemorrhaging 325 stores, a loss of (-6.8%) in units. Natural market share slid to 2.9% from 3.2% last year, with sales remaining about $2.7 billion in both years. The two largest chains, GNC and Vitamin Shoppe, have reverted to private hands. With their shrinking performance and dim prospects, there’s little hope of exciting the public markets as they once did.

In a recent note, cultural ethnographers at The Hartman Group revealed mid-year research that found shifts in COVID-19 shopping habits, with 41% of consumers saying they are now much more likely than ever to stock up at smaller retailers, especially for specific specialty/natural, and harder to find items. Onward 2021!JJ

Sponsored by