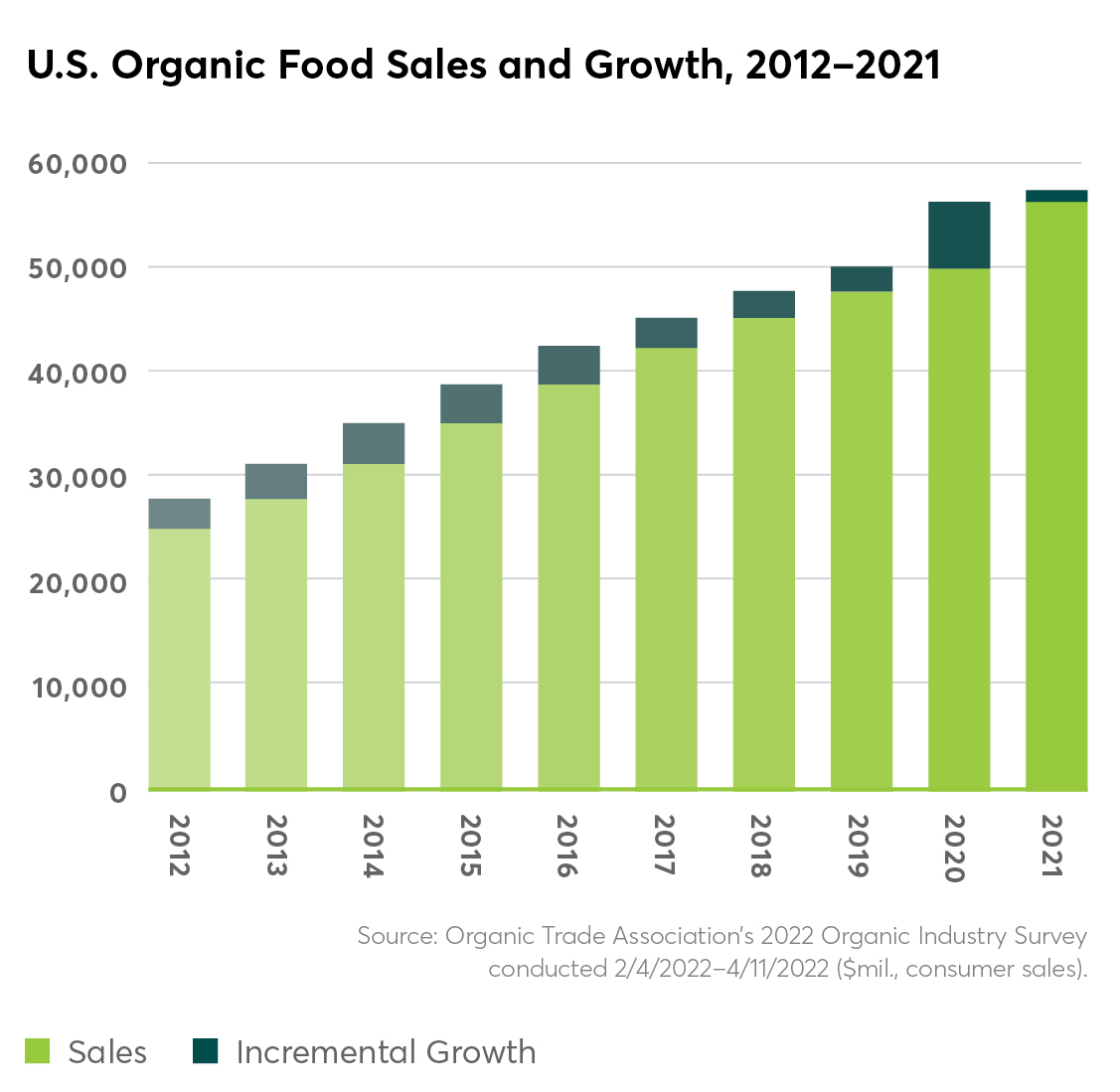

- Between 2020 and 2021, organic sales surpassed $63 billion, growing 2% with $1.4 billion total growth over the year

- Food sales, which make up more than 90% of organic sales, grew roughly 2%, rising to $57.5 billion

- Non-food sales grew 7% to reach $6 billion in sales

“Like every other industry, organic has been through many twists and turns over the last few years, but the industry’s resilience and creativity has kept us going strong,” said OTA CEO and Executive Director Tom Chapman, in the release. “In 2020, organic significantly increased its market foothold as Americans took a closer look at the products in their home and gravitated toward healthier choices. When pandemic purchasing habits and supply shortages began to ease in 2021, we saw the strongest performance from categories that were able to remain flexible, despite the shifting landscape. That ability to adapt and stay responsive to consumer and producer needs is a key part of organic’s continued growth and success.”

Taking a closer look at key categories: