Once touted as merely a fad, or a blip on the global health radar, exotic fruits and grains have settled into being permanent fixtures in the natural products industry. While old standards like pomegranate and açaí have remained strong, even more unique and exciting ingredients from around the world continue to make their debuts in the American market.

Confirming this trend is market research firm Mintel, which predicts cupuaçu (Amazon region) will be the “next big superfruit” this year (1), while Sensient Flavors picks caja fruit (Brazil) and marula (South Africa) as two of its top 10 beverage flavor trends for 2010 (2).

Pete McMullin, vice president at Sibu Beauty, Midvale, UT, confirms, “Superfruits are definitely not a passing fad. It seems to me that has already been shown by the continued popularity, growth and incorporation of mass-market products. There will be many new products, raw materials, delivery methods, etc. in this category. In fact, superfruits already have expanded in growth into different categories such as beauty and personal care.”

Similarly, many exotic grains, also known as ancient or heritage grains, continue to make an impact on American consumers because of their versatility and health benefits. For example, Sandra Gillot, general manager of Functional Products Trading, S.A., Santiago, Chile, says, “Chia seed has over 3,500 years of history and tradition. In pre-Colombian ages, it was one of the core staples of Aztecs, and was used not only as food, but also as an offering to the gods. Furthermore, it was used as medicine due to the quality of its nutrients and the remarkable physical fortitude derived from it.”

Experts agree: exotic superfoods are “here to stay.”

Exotics: Rare, but Are They Fair?

The health benefits of many exotic fruits, superfruits, and grains are astounding, not to mention the allure of trying something new from a far away land. Chris Herbert, working in sales and education for North American Herb and Spice, Buffalo Grove, IL, says, “The countries and remote regions from where we harvest our ingredients have nutrient-rich soils free of all chemicals, fertilizers and other toxic materials,” which certainly adds to their appeal. However, there still exist ethical concerns about the global reach of Americans’ desires to attain these ingredients and products.

Focusing on fair trade. The effect on the people and places from where these foods are sourced has raised much debate. Cultural sensitivities and differences can certainly present challenges for both companies and host regions. James Gibbons, president of Nature’s Plus, Melville, NY, says, “Each country and each material has its own unique set of potential fair trade problems. Whether it is labor issues surrounding the harvest of cocoa, sustainability issues surrounding the harvest of African pygeum or environmental issues surrounding the collection of coral calcium, each situation must be investigated and resolved. Resolving an issue may require that the supplier obtain fair trade certification.”

For many companies, the effect of their presence in foreign regions is something they care about very deeply. Stefan Wypyszyk and Brad Miller of Madera, CA-based Stiebs say, “We strive to have an intimate knowledge of both the fruit and the geographical regions they come from. It’s just as important to understand the impact to the regional environment and economy, as it is to understand the science behind the product. In most cases, a true win–win situation can be found.”

And often, companies’ efforts do not go unnoticed by local authorities.

For example, says McMullin, Sibu Beauty has put in place contracts with local Tibetan harvesters that have spurred new sources of income and jobs in the region. According to McMullin, the Dalai Lama, who occasionally lives in a monastery overlooking one of Sibu’s major harvesting operations, requested to meet with a Sibu official in September of 2009 to personally thank him for the company’s efforts.

Jeff Chandler, senior manager of corporate communications at XanGo, LLC, Lehi, UT, provides another example. He says, “The company received recognition last year from the Royal Thai government for ‘creative use of the mangosteen’ and pioneering the increasing global popularity of this prized superfruit.”

In addition to fair trade certification, many companies take things a step further. For example, Zola Açaí created Project Zola, which focuses on building community infrastructure, improving quality of life and protecting the environment with specific and tangible goals in a 100% transparent environment, says Chris Cuvelier, founder and president of the San Francisco, CA-based company. XanGo, too, is teaming up with charitable partner Operation Smile and the Thai government to support a 2010 medical mission to Thailand.

Can we have the best of both worlds? To obtain the health benefits of these exotic fruits, they must travel to us from the far reaches of the globe, which raises other another ethical dilemma—food miles. In a market that is currently favoring sustainability and locally sourced foods, some wonder if they have to choose between the health benefits of these foods and environmentalism.

McMullin says, “This is a question we struggle with internally. While there is a huge demand for locally grown products and exotic superfruits, we cannot currently provide both.” At this time, the company is actively setting up a new program to start growing sea buckthorn locally. “It will take years to yield any useable raw material, but we feel it will be well worth the effort eventually as sea buckthorn grows in popularity,” he says.

On the other hand, Cuvelier says, “With the strong growth that we have seen in superfruit juices versus regular juices, I think that the consumer is saying that the naturally occurring health benefits of these exotic fruits outweigh the fact that they are not domestically sourced.”

Still, says Gillot, “There is a growing awareness about the origin of the products, where they have been grown and how. Sustainability is a primary concern for our whole organization, from the fields in Bolivia to the customers in the United States.”

The idea of traceability, and by implication, transparency, is crucial so that consumers can make informed choices about their products. For Gillot’s company, all the information is available for the customer and marketing promotes the “sustainable supply chain” built with suppliers. “The consumer can enjoy the benefits from the exotic [chia] seed together with environmental friendly and sustainable production.”

Many companies choose to forgo imports whenever possible and source locally. Jarrow Formulas, for example, uses California pomegranates, says Kaori Shimazaki, Ph.D., technical specialist for the Los Angeles, CA company, rather than importing them from the Middle East, India or China.

So, let’s just plant some cupuaçu plants right here! Right? Not so fast…Many foreign fruits would not thrive in U.S. climates, and the same goes for exotic grains. Mitch Propster, CEO of Core Naturals (distributor of Salba), Maitland, FL, says, “Some of those exotic grains simply will not grow well on native soil and frankly should not. The virgin soils needed for high-impact growth simply no longer exist stateside.”

those exotic grains simply will not grow well on native soil and frankly should not. The virgin soils needed for high-impact growth simply no longer exist stateside.”

This is understood overseas as well. Rodrigo Correa, native Brazilian and marketing manager for Açaí Roots, based in San Diego, CA, adds, “We do understand that it is important to local source whenever it is possible, however, since açaí [and other superfruits] demand a very specific environment and climate condition for production, it might not fall in this category.” As of now, says Correa, less than 5% of the açaí palms in Brazil are being used for harvesting the fruit, so the increase in demand has not had a high impact in the actual supply.

Also, although immediate concerns usually focus on the region from where ingredients are originally sourced, the flipside is how crops from far away places would affect local ecosystems if transplanted to be domestic. “When you move a plant to a new location for agricultural production, you usually have to modify the environment to better suit the crop,” says Gibbons. “This poses risk to the micro-environment of the farm. But, it also poses a much greater risk to the region’s larger environment, since the crop species may escape its surroundings and wreak havoc with native ecosystems.” He uses kudzu as an example (a plant native to Asia), which is sometimes referred to as “the vine that ate the South.”

Wes Crain, vice president of Navitas Naturals, Novato, CA, agrees. He explains it is a “false choice” between environmentalism and choosing to source grains from a distance because recent studies show that certain agricultural regions are simply better suited to produce certain plants; raising them locally creates a greater need for intensive agricultural techniques, and, therefore, is not as “low impact” as importing them from places where they are easy to grow.

The Road to Exotics Comes With Some Baggage

Plenty of other challenges exist when working with exotic ingredients, but demand is high and companies are willing to do what it takes to deliver. According to Gibbons, suppliers who have multiple certifications and organizational memberships such as ISO, kosher, halal and organic tend to have the fewest problems with ethics, fair trade, transportation, spoilage and international regulations. “These companies reinvest in themselves, their technologies and their quality. They are in stark contrast to the unscrupulous fly-by-night outfits looking to make a quick buck on the latest exotic fruit fad,” he says.

Following are some common dilemmas that manufacturers and suppliers face:

• The lay of the land. Some exotic superfruits are coveted because they are simply harder to get to. The physical challenges of harvesting açaí from the Amazonian Rainforest are certainly more extensive than say, those presented in the average apple orchard. Wypyszyk and Miller note, “One of the biggest challenges in dealing with exotic fruits, both domestic and foreign, is properly managing the supply as many of these products only have one harvest season per year. In many cases, you only get one opportunity to buy the fruit and it’s essential to have an intimate understanding of the supply chain and market dynamics to ensure you buy the right quality and quantity at the right price.”

In other cases, Gillot says, the political and economic situation may affect the day-to-day operations of a company, for example, transportation.

• Freshness. Many superfruits and grains have very high oil content, which make them highly susceptible to rancidity. Also, their precious nutrients can be lost in their journey to the manufacturing plant. For example, Correa says, “Açaí is a very tough product to work with. The entire process is extremely difficult and specific and needs to be done within about 12 hours of the harvesting, since otherwise, the fruit loses most of its nutrients. Therefore, all transportation and storage involved in the frozen pulp needs to be frozen.

Herbert adds, “A lot of superfruits/foods have been pasteurized and we know anytime you apply heat to food, vitamins, minerals and antioxidant levels are wasted. We have learned from our forefathers the importance of spices to preserve food, which we use to help preserve our superfood products.” Some of these spices may include rosemary, cinnamon and oregano.

• Sales, marketing and the FDA. The marketing of products utilizing these ingredients is not without challenge either, especially for companies utilizing the potent health benefits of exotic superfoods in their supplements. In fact, it’s difficult to find something without açaí, maqui or some superfruit blended into the mix! But, the recent FDA draft guidance addressing the distinction between beverages and liquid dietary supplements has raised some concerns. The guidance, which places heavy emphasis on packaging, has hit home with many supplement makers who incorporate a lot of these exotic ingredients into their liquid products. Wypyszyk and Miller of Stiebs, note, “It seems that the guidance is an attempt by FDA to clearly define beverages and conventional foods from liquid dietary supplements; however, it is hard to understand how packaging and/or serving size can be the main criteria for this determination.”

An argument presented by the law firm Ullman, Shapiro and Ullman alleges that FDA’s focus on packaging is an attempt to classify more products as conventional foods, and thus reclaim additional regulatory control over them.

Steve Kravitz, president of Earth’s Bounty/Matrix Health Products, Vancouver, WA, notes that the manufacturer’s intent and the contents of a product should determine its classification as a beverage or a supplement, not necessarily the shape/size of packaging. For example, whether a product is meant to quench thirst, provide an energy boost or fortify one’s diet, the manufacturer’s intent (including serving size) should be clearly labeled, thus placing responsibility on the consumer to, well, read.

Some feel that further FDA meddling may only result in further confusion. Neil E. Levin, CCN, DANLA, nutrition education manager for NOW Foods, Bloomingdale, IL, says, “The draft guidance seems to be at odds with specifics of current regulations and could serve to confuse both industry and consumers. For example, saying that a certain packaging or serving size defines a product category is not always consistent with the definition of a dietary supplement and how it is used.”

The issue becomes part of the larger problem regarding FDA’s opinion-based determination of what constitutes a supplement.

Gibbons argues, “Naturally, we in the health supplement industry are skeptical of any FDA guidance that serves to restrict the presentation of a dietary supplement to merely those forms that fit the agency’s narrow view of what supplements should look like. For example, it is not clear how such drinks as herbal teas and the like would fair under this guidance…Thus, we would caution all stakeholders to voice their opinions on the ramifications of establishing such limits.”

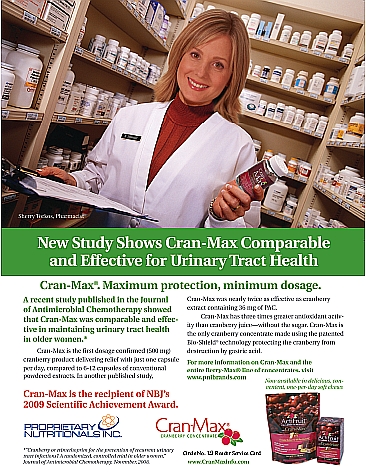

The impetus for this guidance includes the controversy surrounding so-called “energy drinks,” for example, those containing guarana, a highly caffeinated Amazonian superfruit. Because of this, some in the industry support the initiative to make clear the differences between types of liquid products. Dean Mosca, president of Proprietary Nutritionals, Inc., Kearny, NJ, says, “As nutraceutical beverages continue to flood the market and be heavily consumed, there does need to be further definition between this delivery form either as a supplement or simply some sort of fortified beverage, which would contain very few nutraceuticals or a very low amount of the RDA of established vitamins and minerals.”

ORAC Attack

Everywhere we look now, we see four bold letters jumping out at us from product labels: ORAC. ORAC, or Oxygen Radical Absorbance Capacity, has become industry’s latest, and very debatably greatest tool for expounding the benefits of a product’s antioxidant capacity.

ORAC has certainly garnered a lot of attention lately, but also some strong, varying opinions. Many contend that consumers don’t understand the true meaning of ORAC, seeing it as a marketing tool while others believe it is a step in the right direction for understanding antioxidant values. While some ingredients have extremely high ORAC values, some companies choose to focus on the unique attributes of the fruit in differentiating them from other superfoods. For example, says McMullin, “Sea buckthorn is also high in omega fatty acids, specifically omega-7, which is very rare,” he says.

How super is that fruit?

Essential fatty acids, amino acids, proteins, phytosterols and carbohydrates are all some of the amazing nutritional benefits associated with superfoods, but are not measured by ORAC, leading some to believe that the measurement does not show consumers an accurate depiction.

“I believe consumers have a common misconception in understanding the ORAC value as it relates to all the different options in the consumption of nutritionally dense foods. Consumers should consider many different nuances in nutrition and incorporate variety to obtain the cornucopia of available phytonutrients,” says McMullin. Nutrients have varying bioavailabilities and often have specific therapeutic targets. Therefore, it seems, ORAC cannot be the determining factor for how “super” a fruit or grain really is.

Shimazaki also notes that some products with high ORAC values may also contain large amounts of sugar, fats and calories.

Another crucial issue related to the use of ORAC is that it can be difficult for the consumer to decipher between the many ORAC-based products. Wypyszyk and Miller point out, “Consumers must be aware of comparing ORAC products based on the same ORAC units.” One ORAC unit is equal to the equivalent antioxidant capacity of one micromole (µmole) Trolox, a noncommercial, water-soluble form of vitamin E, referred to as TE (Trolox Equivalence). What can be confusing for the consumer, they say, is how the ORAC value is stated for various types of products. “Whole foods, such as a serving of blueberries, report ORAC values as µmoles TE per 100 grams, while extracts and supplements report ORAC values as µmoles TE per gram. Beverages report ORAC value per serving. To further complicate the matter, many ORAC products don’t even report units in their ORAC claim, simply stating a number.”

ORAC doesn’t easily translate past the superfruits category either; for example, in use with grains. There is general knowledge, says Gillot, that wild berries have many antioxidants, and therefore high ORAC values. So, in terms of marketing and packaging materials, chia’s ORAC value must be related to the values of berries (as in “chia seed has three times more antioxidants than blueberries”).

Others believe that although the ORAC system is imperfect as of yet, it still has its merits. Gibbons says, “Prior to ORAC, the consumer had no way to compare the antioxidant activity of one product to another…Eliminate ORAC and we’re back to a guessing game about the antioxidant activity of antioxidant supplements.”

The idea that the higher the ORAC value, the better the product, is bad for the long-term market because it causes manufacturers, retailers and consumers to focus only on an ORAC number and not other research. It is within these other types of research that the true potential benefits of these foods and products can be seen. For example, a 2009 double-blind, placebo-controlled, randomized human clinical pilot study published in the Nutrition Journal found a proprietary mangosteen juice (XanGo Juice) to lower markers of C-reactive protein in the body (a key marker of inflammation) and reduce body mass index for overweight study participants (3).

Angela Vrablic, Ph.D., nutrition research manager at American Health, Ronkonkoma, NY, agrees that scientific support is of utmost importance: “This is not a case where the more exotic and expensive, the better.”

I’ll have three million ORAC, please. It’s not uncommon to see a product label touting ORAC values reaching hundreds of thousands. This raises the question if a maximum number exists for effectiveness. For example, extremely high levels of certain nutrients simply cause the body to excrete the excess. Does the same logic apply to antioxidants?

Shimazaki addresses the question, “Since there is no scientific data to elucidate the degree of absorption and functionality exhibited by some concentrated supplements with very high ORAC values, it is difficult to evaluate the true benefits of such high concentrations of antioxidants in human health.”

Although many of these specifics are still being researched, the importance of antioxidants cannot be understated. Herbert says, “Antioxidants are used daily and rapidly by the body. We are physically and mentally under stress. Poor soil quality, water pollution, air pollution, chemical fertilizers and the pasteurization, homogenization, irradiation and genetic modification of crops all affect the balance of antioxidants within our bodies. So, can we get enough from superfruits and superfood today? Highly unlikely.”

|

Select Product Offerings: Açaí Roots: RTD beverages (juice and smoothies), frozen açaí pulp, organic freeze dried açaí powder, açaí liquid concentrate, açaí energy shots and açaí pills. American Health: Ester-C Advanced Antioxidant Formula. Core Naturals (Salba): Whole seed and milled Salba; raw oils; and Salba Life Whole Food Bars. Earth’s Bounty/Matrix Health Products: Superfood Gold. Functional Products Trading, S.A.: Grower of Benexia Chia products including Benexia Chia Seed, Benexia Chia Oil, Benexia Defatted Chia Flour and Benexia ALA Powder. Jarrow Formulas: PomeGreat Pomegranate Juice Concentrate, PomeGreat Pomegranate + Blackcurrant Red Grape Juice Concentrate, PomeGreat Pomegranate + Blood Orange Juice Concentrate, PomeGreat + Grape + Blueberry Juice Concentrate, PomeGreat PomeZotic, Blackcurrant Juice Concentrate, Blackcurrant Freeze-Dried Extract, PomGuard, Organic Berry High and Cran-Clearance. Kamut International: Supplier of Kamut brand grain. Nature’s Plus: A full line of supplements including açaí, goji, noni, mangosteen and pomegranate. Navitas Naturals: Organic chia, hemp and flax; açaí, maca, cacao, goldenberries, goji berries, mulberries, wakame, nori sheets, lucuma, camu, raw cashews and yacon; five varieties of Power Food Powder Twister Blends; three blends of Trail Power snack mixes; three varieties of Organic Superfood Chocolate Kits; and, the Sweet Tooth line of sweeteners (yacon syrup, organic green stevia and palm sugar). North American Herb and Spice: Bluebenol, Brambenol, Cherinol, Lingonol, Strawbenol, Pin Cherry Extract, Chag-o-Charge, Chag-o-Power, Lovely Larch Tea and Bet-u-Birch Tea. NOW Foods: A variety of products with açaí, goji, noni, mangosteen, pomegranate, maqui, raspberry, blueberry, blackberry, black cherry, cranberry, chia, quinoa, amaranth, spirulina, chlorella, alfalfa, flax and more. Pacific Grain and Foods: Premixed sodium-free pilaf blends with vermicelli added to rice or bulgur; dehydrated tropical fruit trail mixes; banana, sweet potato, cassava, and plantain chips; a large variety of rice, beans and flour; and puffed durum wheat. Proprietary Nutritionals, Inc. (PNI): Berry-Max line, Cran-Max. Sibu Beauty: Sea buckthorn liquid dietary supplement; 100% pure sea buckthorn seed and fruit oil gel-caps; topical creams, soap and treatment oil. Stiebs: Fruit-based juices, concentrates, purees, powders and extracts from pomegranate to prickly pear cactus. XanGo: XanGo Juice, Glimpse Topical Skin Nutrition, Mineral Treatment and the Juni Family Care line. Zola Açaí: Zola Açaí Juices and Zola Light Açaí Juices; Zola Açaí Superfruit Smoothies (Energy, Immunity, Antioxidant and Superfood blends) and, Zola Açaí Daily Wellness Shot. |

Some experts say they have a general idea of the appropriate daily antioxidant intake. According to Correa, “The maximum number of ORAC units the body appears to be capable of handling is between 3,000 to 5,000 units. This occurs because the antioxidant capacity of the blood is tightly regulated. Taking in 50,000 ORAC units at a time would not be more beneficial than taking 5,000 units; the excess is simply excreted by the body.”

Rather than focusing on the highest antioxidant number possible, variety may be of more importance. Levin says, “Because of complex biological processes, it is important to get both a variety of water-soluble and fat-soluble antioxidants rather than loading up on one source. The antioxidant pigments (carotenoids, lutein, lycopene, astaxanthin, anthocyanin, etc.) can vary from food to food as well, requiring a balanced diet of varied sources.”

Exotic Grains: What’s Old Is New

Exotic grains are certainly not new, but are making a resurgence in the market. Ironically, many of these are also referred to as ancient, or heritage grains, and are being thought of as new and innovative avenues toward health.

Lee Perkins, president of Pacific Grain and Foods, based in Fresno, CA, says, “What’s old is new again with the rediscovery of common and exotic grains as in breakfast foods like amaranth, quinoa, spelt, teff, oat, buckwheat and the very ancient farro (wheat). These are all inexpensive, healthy and exotic grains with high protein [that are also] gluten and allergy free.”

Another benefit, Levin notes, is that grains and seeds offer vegan sources of omega-3 fatty acids and fiber.

Also interesting is that many people with sensitivities to modern wheat can enjoy these ancient grains. Bob Quinn, founder of Kamut International, Big Sandy, MT, says, “Although there is some difference in the gluten between ancient and modern wheat, it appears that the most important differences lie in the nature of the starch in the grain, the amount and availability of antioxidants, including several important secondary metabolites that have been reduced or lost in modern wheat, as well as some indication of a mechanism that blocks the development of inflammation.”

Bulking up your store. Retailers can make sure exotic grains are as accessible to shoppers as possible by setting up a great presentation. Crain says it is imperative that marketers and their retail partners provide educational materials, in-store demos, special promotions and coupons to get people to try products.

A bulk section to accommodate grains can add a lot of value to a retail store. Perkins says, “Retailers should always pass on savings to consumers and bulk foods sales are the best ways to do that.” The following tips are crucial for setting up your bulk section:

• a lower-priced bulk foods area with acrylic see-through containers,

• bulk foods dispensing using sanitary scoops, dispensers, bagging supplies and ties,

• visible recipes and nutrition panels for all bulk food products sold

• hold tastings or offer cooking classes and demonstrations about how to utilize these unfamiliar grains in easy, tasty ways. Perkins notes, “Retailers have a responsibility to help educate the consumer and tell the story of food and how it is to be prepared and used: snack, side dish or main course.”

Quinn adds, “Bulk provides an opportunity for those with lower incomes to still buy organic food for their families.”

GMOs. A lot of Americans are becoming aware of the influx of genetically modified organisms (GMOs) in the products they buy, but many are still unaware of how prevalent the problem is. Propster says, “Unfortunately, I don’t believe that most consumers are actually choosing, but instead are allowing the choosing to be done for them, due in part, to a lack of education. There are still quite a great deal of consumers that don’t even know what GMOs are and much less that realize the inherent dangers of them.” This raises the question of whether these GMO concerns extend past potatoes and corn to the exotic grains category.

Many have pointed fingers at the agricultural giant and biotech firm Monsanto Company, headquartered in St. Louis, MO. Crain address the issue: “The GMO issue is primarily driven by Monsanto, and Monsanto is driven by profits and shareholders. Currently, there is not enough money and profits to be made from these other grains for Monsanto and other huge corporations to get involved with genetic issues associated with these other ‘new’ grains, perhaps with the exception of rice.” So, for now, it seems that many varieties of heritage crops, such as chia and quinoa, are safely out of the loop.

However, for some companies there is still concern. For example, domestic companies working with khorasan wheat (a heritage grain commonly known as the trademarked Kamut) are feeling some pressure. “There is great concern with GMOs,” says Quinn, bringing up the fact that Monsanto recently announced that its GMO wheat project is back on the drawing board after having been shelved for some time because of the opposition of foreign markets. GMO contamination is also a very real concern for domestic and foreign companies. “Each time this happens,” he says, “there is a huge drop of confidence in U.S. and Canadian food exports and a resulting decrease in the grain market prices. This drop in price greatly punishes the farmers growing those crops even if they are not growing any GMO crops at all.”

Globally, the GMO issue is being scrutinized. But, Quinn continues, “Unfortunately the United States has taken a back seat on this issue as most U.S. government leaders have sided with Monsanto in not just allowing their GMO project with minimal discussion or testing, but officially promoting it around the world. Many of our wiser friends in Europe and Asia are asking the hard questions about food safety, demanding, and in many cases requiring, the labeling of GMO foods and supporting research to determine the extent of the health threat, especially to children.”

And so, it has become our responsibility to educate consumers about the GMO situation, as well as the benefits of local and exotic natural ingredients. WF

References:

1. Mintel Press Release, “Mintel Predicts Flavor and Scent Trends for 2010,” Nov. 2009, www.mintel.com, accessed March 3, 2010.

2. Sensient Flavors Press Release, “Sensient Flavors Announces Top 10 Beverage Flavor Trend Profile Predictions,” Dec. 2009, www.sensientflavors.com/English/news/item/23/, accessed March 3, 2010.

3. J. Udani, et al., “Evaluation of Mangosteen Juice Blend on Biomarkers of Inflammation in Obese Subjects: A Pilot, Dose Finding Study,” Nutrition Journal 8:48, 2009.

Published in WholeFoods Magazine, April 2010