Recently, several natural products retailers have asked me about discounting in the form of “rewards” or “loyalty” programs. Because most natural products retail stores operate on thin net profit margins—usually 4–6% before paying taxes—discounting in any form can badly damage your profits and, at worst, may be devastating to your entire business.

Simple math tells us that, if your pretax net profit—meaning the money you have left over after paying all your direct store expenses, but before you’ve paid income taxes—for example, is 5% and you offer a 10% discount, you will put your store in an unprofitable position, losing money on every sale.

We’ve Seen This Picture Before

Maybe you are considering a discount program to bring back lost customers, to satisfy price-sensitive ones or just to try to stabilize or increase sales. If so, realize that you are about to make a change to your business that—if you’re not happy with the results—will be very hard to undo. While the competitive world of natural products retailing may look very different today compared to 30 years ago, the universal laws of profit and loss remain.

Here’s the story of Charlie, owner of the Organic Food Cellar in Cambridge, MA, who 30 years ago tried to combat the competition by discounting. It was 1980, and a new retailer called the Natural Grocer had just opened up in the Boston area with locations directly across the street from some of the largest and most successful natural food stores at the time. Large in those days was 6,000 square feet. The Natural Grocer disrupted the market—for a short time, anyway—by discounting 10% off all products every day. Being in the wholesale natural foods distribution business at the time, I began receiving frantic phone calls from existing naturals retailers seeking extra discounts to help combat this new threat.

The Organic Food Cellar was a very busy and successful natural foods store, and one of those directly affected by the Natural Grocer. Charlie decided to match Natural Grocer, and lowered his everyday prices by 10%. To Charlie’s delight—at least initially—sales went up. But, within a year, Charlie, the Organic Food Cellar, and the Natural Grocer were all out of business. What happened?

Profit Squeeze

One of the unintended consequences of lowering your price level by discounting is that it creates a profit squeeze from the top and from the bottom. If you are a half-million dollar store annually, and you take 10% off your prices, you just sliced $50,000 off of the retail value of your inventory—and your sales. For every transaction that used to bring in $1.00, you are now putting just 90¢ into your cash register. This is the profit squeeze from the top, which compresses the amount of money you have available to pay for all your products and expenses.

But it is the profit squeeze from the bottom that may be the ugliest surprise waiting for you the next time you open up your checkbook to pay your bills. Here’s how it works. Even though you’ve cut the retail prices of your products by 10%, you have not changed your operating costs. You must still pay the same amount for your products—your cost-of-goods—and you must still order, receive and stock those items on your shelves, run your refrigeration and freezers, come up with your monthly rent, bank fees, telephone, computer, advertising, accounting and pay your employees every week. These costs don’t go down simply because you’ve lowered your retail prices. In fact, these costs go up as a percentage of your sales, and increase your cost structure permanently.

Profit and Loss—The Ugly Truth

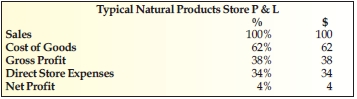

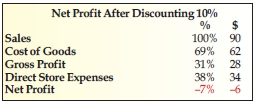

I know that too many numbers might make your eyes glaze over, so I’ll be as brief and to the point as possible. We are going to look at just five numbers from your profit-and-loss (P & L) statement: your sales, cost-of-goods, gross profit, direct store expenses and net profit. Here’s a typical natural products retail store P & L showing these items, using $100 as our unit of measure. To keep it simple, I’ve rounded fractions to the nearest whole number:

Of course, your store may have different cost percentages, but the impact discounting will have on your operating percentages will be largely the same. For net profit, we mean money you have left over after paying all your expenses, but before paying your income tax. Direct store expenses include all costs of running your business; labor, rent, advertising and others. Cost-of-goods reflects what you paid your suppliers for product, after all discounts, and including “shrink;” outdated, damaged or returned merchandise that you paid for but can’t sell or return for credit. Gross profit is simply the chunk of money you have left over after paying for product, but before paying for anything else. Gross profit plus cost-of-goods percentages always equal 100%.

To see what happens to your P & L when you discount, we’ll take each item separately first, and then combine them at the end.

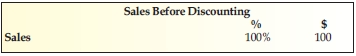

Sales: Before discounting, your sales are $100, which equals 100% of your sales.

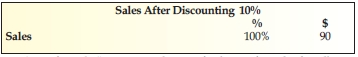

Sales after discounting 10%: Now $90 equals 100% of your sales.

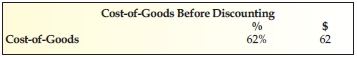

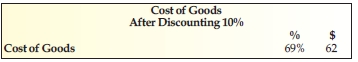

Cost-of-goods: In our example, your final cost-of-goods after all supplier discounts and shrink is 62% before you install your 10% retail discount.

Cost-of-goods after discounting 10%: You still must pay your suppliers $62, but instead of bringing in $100 by selling these items, you now bring in only $90. This makes your $62 cost-of-goods go up as a percentage of your now-$90 in sales, to 69%.

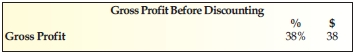

Gross profit: Before lowering your retail prices, you have 38% gross profit.

Gross profit after discounting 10%: Because you are paying for your discount to your customers out of your own pocket, the 10%—and the $10—comes directly out of your gross profit. Remember, the percentage for gross profit plus cost-of-goods always equals 100%. You now have $28 instead of $38, and 31% instead of 38%, in gross profit.

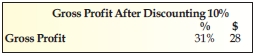

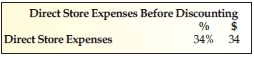

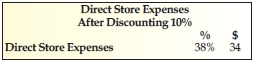

Direct store expenses: Before discounting, your direct store expenses run 34% of sales.

Direct store expenses after discounting 10%: Even though you are taking in less money in sales, it is still costing you the same amount of money to make those sales. Therefore, you will still spend $34 to make $90 in sales, which raises the percentage it costs you to operate your store from 34% to 38%.

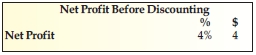

Net profit: Before you begin your discount program, you take home 4% after all expenses.

Net profit after discounting 10%: After you begin discounting, net profit disappears. The “bottom line” tells the story; you are losing 7% on every sale you make.

Discretion Is the Better Part of Retailing

Perhaps you are thinking of only discounting 5%. Using the same example, your bottom line will still be negative 1%. Even if you discount just 2% or 3%, you will be putting your bottom line profits in jeopardy.

There are ways to avoid this. First, go to your suppliers and ask them for additional discounts. But remember, you must fully pay for your retail discount with offsetting supplier discounts, and that is pretty difficult to do. Perhaps you have a fatter bottom line than our example 4%. But even if you have, say, an 8% net profit, and you give only a 2% discount, you are rifling 25% of your net profits. On a $1 million store, that’s $20,000 less profit, or $60,000 instead of $80,000.

Please don’t make the mistake of thinking you’ll “make it up on volume.” Once your direct store expense percentage (38%) exceeds your gross profit percentage (31%), your bottom line will always be negative. Perhaps you’ll decide the risks  outweigh the “rewards.” WF

outweigh the “rewards.” WF

Jay Jacobowitz is president and founder of Retail Insights®, a professional consulting service for natural products retailers established in 1998, and creator of Natural Insights for Well Being®, a comprehensive marketing service designed especially for independent natural products retailers. With 35 years of wholesale and retail industry experience, Jay has assisted in developing over 1,000 successful natural products retail stores in the U.S. and abroad. Jay is a popular author, educator, and speaker, and is the merchandising editor of WholeFoods Magazine, for which he writes Merchandising Insights and Tip of the Month. Jay also serves the Natural Products Association in several capacities. He can be reached at (800)328-0855 or via e-mail at jay@retailinsights.com.

Published in WholeFoods Magazine, March 2012