Truth #1: Competition tends to reduce profit margins by putting downward pressure on retail prices.

Truth #2: The more competition, the greater the pressure to lower prices.

Truth #3: A growing industry will attract more competitors.

Are you feeling pressure to lower your prices? If so, it’s understandable. We are in the most rapidly growing, hotly contested sector of an industry in which every person on the planet participates—by eating—every day. Does anyone predict pricing pressures will ease?

As an independent natural products retailer, you’re facing a lot more competition today than you did yesterday, with more on the way tomorrow. After all, the food business is an industry so large and volatile that it, along with the energy sector, is one of the two macro categories the U.S. Federal Reserve (the folks who set our interest rates) excludes from its inflation calculations.

And, we are no longer the niche player in foods we once were. What began nearly a century ago as nutritional fortification for the informed few, and 50 years ago morphed into the natural foods movement for the back-to-the-Earth granola-and-Birkenstock set, has blossomed into mainstream consciousness embraced by most U.S. households on a regular basis, and is now being propelled to new heights by the youngest and largest quality-driven generation in our history, the Millennials. Yes, today, natural products have reached critical mass.

How Big Is It?

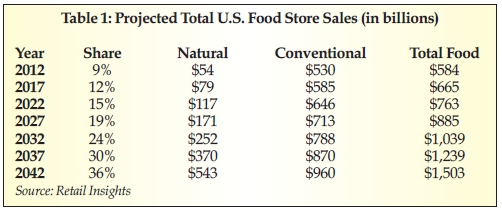

Each year, my company, Retail Insights, measures the market for U.S. natural and organic product retail sales, tracking more than 100,000 retail stores in eight separate channels, such as mass market, supermarket, vitamin chain store, club store, pharmacy and others. As of 2012, we estimated natural products market-share of all food store sales reached 9%, or about $54 billion of the $584 billion total. (For a detailed table of these retailers and their results, please see the 35th Annual Retailer Survey).

More important than our current market share, however, is the growth rate for natural and organic products, which is outpacing the growth of conventional foods by a factor of four to five times. We have been observing this growth disparity between natural and conventional foods for the last 30 years, and believe, with the coming-of-age of the quality-driven Millennials, we will continue to see natural gobble up market share from conventional foods for at least another generation.

But if you’ve been following the steady growth of natural products over the last 30 years, you may assume that the next 30 will look and feel about the same. But this is not likely to be the case.

If you simply track the two growth-trend lines of natural and conventional foods—roughly 8–10% annual growth for natural versus 1–3% growth for conventional—you’ll see that the changes to come will not be a gently swelling tide. No. Think tsunami.

In Table 1, we used an 8% growth rate for natural products and a 2% growth rate for conventional foods, which is on average what we’ve observed for the past couple of decades. By 2042, the next generation 30 years from now, natural products will make up more than one-third of all food store sales. And, because the total pie will also be larger, our industry will have multiplied by a factor of 10, to more than $540 billion from $54 billion in 2012.

Along with our rapid growth comes the competitive pressure you’ve been feeling to lower your prices. And if you’re familiar with my long-held view on pricing, you’ll also know that I am adamantly against using discounting as a competitive weapon. But this does not mean that you can’t price smartly and competitively while protecting your profit margins.

Fatter Margins

In fact, gross profit margins for independent natural products retailers have fattened up over the course of the last 30 years. When I first got into the business in the late ‘70s, it was common for “natural foods stores,” meaning stores that had a majority of sales from foods, and usually 15–25% of sales from vitamins and supplements, to have overall gross profits margins in the 28–33% range. Today, a store with a similar product mix will typically enjoy overall average gross profits of 34–38%, a significant shift for the better. How can this be?

I believe the improvement in gross profit margin developed mostly as a function of increased volume buying. In the early days, the wholesale price was fairly stable, with few discounts offered by either full-line catalog trucking distributors or direct vendors of vitamin and supplement lines. As industry volume grew, distributors began offering a sliding scale of discounts to their higher-volume retailers, subtracting several percentage points off the bottom of the entire invoice on delivery. At the same time, direct vitamin and supplement lines, in order to secure and maintain dedicated shelf space in an increasingly competitive environment, also began offering “volume discounts” for placement, and a commitment to a certain level of wholesale purchasing the retailer agreed to meet.

What retailers decided to do with the extra profit margin usually depended on the type of trade area the store operated in. In the more densely populated and therefore more competitive trade areas—think New York City—retailers were more likely to pass on the extra volume discounts to the customer. But in less densely populated areas, where retailers faced relatively less competition, many were inclined to pocket some or all of the extra profits from vendor volume discounts.

Walking a Profit Tightrope

Even though gross profit margins have improved significantly, the costs of operating a store have also risen. The net effect of fatter gross profits but higher operating costs has left the bottom line—net profits—mostly unchanged. Depending on what type of store you have, and how good a manager you are, your pre-tax net profits will likely fall somewhere between 5% and 10%. So, as you consider repositioning your pricing to a more competitive posture, you’ve got to be extremely cautious that you don’t damage your fragile bottom line.

What I am not suggesting is tampering with the volume discounts you’ve arranged with your rolling-stock trucking catalog distributors. These across-the-board off-invoice volume discounts are likely critical to your ability to maintain overall store profitability, particularly in today’s more costly operating environment.

What’s the Real Retail Price?

What I am suggesting is that you revisit those individual product lines where your margins have become permanently fatter. I refer to certain vitamin and supplement lines where you enjoy, or have negotiated, an ongoing off-invoice discount.

The critical word in this last statement is “ongoing.” I do not mean, for example, periodic discounts you get such as line-drives or trade discounts that are part of cyclical national promotional activity. I mean extra percentage points that apply to every single purchase you make from your vendor, regardless of your order size or any performance requirement.

In this case, I believe you are safe to assume that the real retail price is the one that reflects your ongoing discount, because your vendor is probably giving the same discount you get to everyone your size or larger.

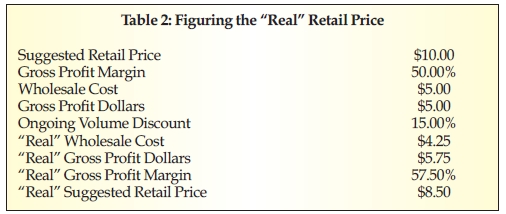

On a standard 50% gross-profit-margin vitamin line where you get an ongoing 15% allowance, for example, if you maintain the suggested retail price (SRP), you are actually making 57.5% gross profit. In our rapidly expanding, highly transparent (think “showrooming” and smartphone price-comparison apps) world of natural products retailing, these extra-fat margins are not sustainable. Assuming a $10 SRP, the “real” suggested retail price for this product should be $8.50, which would, alongside your ongoing 15% discount, still allow you to make your full 50% gross profit margin.

Perception Is Everything

However, as we’ve recently seen with the failure of department store J.C. Penney’s everyday low price (EDLP) strategy, which replaced its inflated-prices/deep-discounts strategy; sales have dipped dramatically, and they’ve just fired the CEO that instituted the EDLP program. Shoppers apparently do not appreciate or understand a lower real, but therefore “non-discounted” everyday price. Our current industry pricing structure of inflated (read “phony”) retail prices, coupled with unpublished yet ongoing off-invoice wholesale discounts, more or less force you to “discount” off these artificially high SRPs in order to maintain a competitive price point.

So, as much as I hate to say it, if you’ve got an ongoing—not periodic or temporary—discount that permanently boosts your vitamin or supplement line gross profit margin above the standard percentage of 40%, 45% or 50%, you probably need to institute a faux-discount program on those lines, marking down from the inflated, fake SRP by the percentage of your ongoing wholesale discount to bring your gross profit margin down to the standard percentage. If not, you’re giving your customers an additional, and unnecessary, incentive not to shop with you.

By the way, if you are an independent natural products retailer and would like to participate in WholeFoods Magazine’s 36th Annual Retailer Survey for 2013, please e-mail kaylynnebner@wfcinc.com, or call Kaylynn at (908)769-1160 to get your survey form. WF

Jay Jacobowitz is president and founder of Retail Insights®, a professional consulting service for natural products retailers established in 1998, and creator of Natural Insights for Well Being®, a comprehensive marketing service designed especially for independent natural products retailers. With 36 years of wholesale and retail industry experience, Jay has assisted in developing over 1,000 successful natural products retail stores in the U.S. and abroad. Jay is a popular author, educator, and speaker, and is the merchandising editor of WholeFoods Magazine, for which he writes Merchandising Insights and Tip of the Month. Jay also serves the Natural Products Association in several capacities. He can be reached at (800)328-0855 or via e-mail at jay@retailinsights.com.

Published in WholeFoods Magazine, July 2013